Earlier today, Unity began trading post its IPO. We sent the following memo to our limited partners to detail our excitement about Unity’s prospects over the long term.

Unity may be the next great creative software company. As the company continues to grow into three major market opportunities ahead of it over the next decade plus, we think Unity could ultimately become the next Autodesk ($50 billion market cap) or, in a bull case, Adobe ($228 billion market cap). Autodesk’s market cap is 3x higher than Unity’s at the IPO price. Adobe’s is 14x higher.

We are currently investors in Unity and remain excited about the company’s prospects post-IPO. Our initial investment in Unity two years ago was predicated on three core theses:

- Gaming as a Social Network. Fortnite had recently emerged as a massive social network. This demonstrated to us the power of gaming as a communication medium, not just an entertainment medium. At the time, gaming was at an inflection point, emerging as a “third place” where Millennial and Gen Z consumers spend time. The idea of a third place comes from Starbucks founder Howard Schultz who described Starbucks as “a third place between home and work.” Since our investment, we think gaming is now established as a third place for Millennials between home and work. For Gen Z, games are the third place between home and school. In some ways, gaming may now be the second place as the pandemic has made both work and school at-home activities for many.

- Merging the Physical and Virtual Worlds. We believed that the physical world could be transformed more rapidly by thinking about it more like a game. Industries outside of gaming were turning to 3D development platforms like Unity to create interactive, immersive experiences intended for use in the physical world. Engineers, architects, and other industrial/manufacturing designers used Unity to create unique digital outputs that increased the effectiveness and efficiency of their work, ultimately saving time and money.

- Augmented and Virtual Reality. Augmented and virtual reality were suffering the classic false start that afflicts many new technologies; however, we believed then, and continue to believe, that AR and VR remain potentially transformative technologies over the next decade plus. AR and VR provide long-term optionality for Unity, as the emergence of both technologies will create an acute demand for rich 3D experiences. Even though the AR/VR markets are both still early, Pokémon Go, a simple AR game that is built on Unity, eclipsed $900 million in revenue in 2019. More of these success stories will come as AR adoption increases, and we expect Unity will be the engine that powers the majority of them.

Two years after our investment, we believe all three of these theses remain intact. Unity’s core gaming engine remains the easiest-to-use platform to develop gaming content, powering over half of all games, including a prime third place example, Fall Guys. Industries outside of gaming continue to adopt 3D development platforms, and we believe the recent shift to work-from-home has accelerated this transition. Unity also powers over half of all augmented and virtual reality content. While the timing and impact of AR/VR remains difficult to predict, the eventual adoption of both technologies will be a significant incremental demand driver for Unity.

Beyond our market theses, we think Unity’s competitive position has remained strong since our investment, maintaining its leadership among 3D content developers by creating the easiest-to-use toolset while Unreal Engine serves the high end.

The following memo outlines our view on the most important pieces of the Unity story and why we remain excited investors. While we are investors, we do not have access to any information beyond public filings. As such, any estimates in this memo are our own work based on that public information.

The Basics of Unity

Product

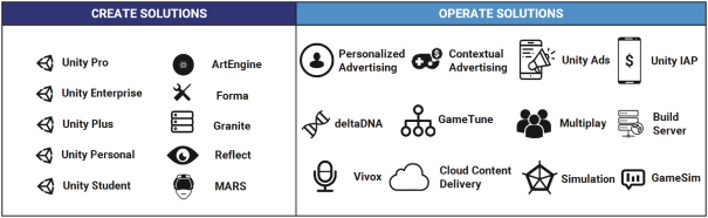

Unity offers an end-to-end development platform for creating rich, interactive 2D, 3D, VR, and AR experiences. Unity offers two interrelated sets of solutions: Create Solutions and Operate Solutions. Create Solutions offer developers, artists, designers, engineers, and architects software tools to create immersive and interactive experiences. Operate Solutions offer customers the ability to grow and engage their user bases, as well as host and monetize their content.

In 2019, Unity generated $542 million in revenue, up 42% from the prior year. In the first half of 2020, Unity did $351 million in revenue, up 39% from the same period in 2019.

Unity Product/Service Offering

Create Solutions

Unity’s Create Solutions segment consists of a graphics engine and full-featured editor which serve as the foundation for many developers building games or immersive apps. Create Solutions are offered to developers on a subscription basis and account for about 29% of revenue as of the June 2020 quarter. In 2019, Create Solutions revenue grew 34% from the prior year. In the most recent June quarter, Create Solutions was up 39% year-over-year. We believe the acceleration may be driven by an increase in customers working from home as well as expanding penetration in non-gaming industries.

Operate Solutions

Unity’s Operate Solutions include products for monetization, engagement, and content delivery. Monetization is the biggest component of the Operate segment and includes Unity Ads and Unity IAP (in-app purchases). In 2019, Unity revealed that it had built the world’s third-largest video ad network behind Google and Facebook. While Unity Ads and IAP were developed internally, several of Unity’s recent acquisitions, including Multiplay (2017), Vivox (2019), deltaDNA (2019), help build out the suite of tools available as part of Operate Solutions. deltaDNA is an engagement tool that helps developers with analytics. Multiplay and Vivox are content delivery tools that help with hosting and in-game communication between players.

Operate Solutions accounted for about 62% of revenue in the June 2020 quarter. In 2019, Operate Solutions revenue grew 59% from the prior year. In the most recent June quarter, Operate Solutions was up 63% year-over-year, likely benefitting from more ad impressions as users spent more time gaming.

Addressable Market

In Unity’s S-1 filing, the company outlined a $29B total addressable market today, separated into Gaming ($12B) and industries outside of gaming ($17B). As mentioned before, we continue to believe that AR and VR remain potentially transformative technologies and would meaningfully expand the TAM as the technologies emerge. The company seems to concur, mentioning AR and VR as potential opportunities.

Gaming Customers

We believe that gaming generated well over half of Unity’s Create Solutions revenue in 2019 and the vast majority of Operate Solutions revenue. We believe this means that Unity is mid-to-high single digits penetrated into what it sees as the gaming market opportunity but recognize that the company faces strong competition in this segment from Unreal Engine, Google, Amazon, and others.

To put the gaming opportunity in perspective, Unity estimates their addressable market at $12 billion. Newzoo estimated the global gaming industry at $159 billion in 2020. Unity’s addressable market represents about 7.5% of total global gaming revenue.

Major game titles created with Unity’s Create Solutions include Arena of Valor, Pokémon Go, and Fall Guys (case study here). Customers of Unity’s Operate Solutions include Electronic Arts, Private Division, Tencent, and Ubisoft Mobile Games. Respawn, an Electronic Arts subsidiary and developer of Apex Legends and Star Wars Jedi: Fallen Order, uses Multiplay for game server hosting. Ubisoft, developer and publishers of Rainbox Six Siege, uses Vivox for in-game voice and text chat.

Industries Beyond Gaming

As Unity continues to expand into other categories, gaming will decrease as a percentage of Create Solutions revenue but likely remain the vast majority of Operate Solutions Revenue. The company noted in its S-1 that of the 716 customers that spent over $100,000 with Unity over the past 12 months as of June 30, 2020, only 8% of those customers were in non-gaming industries. This suggests that Unity’s penetration in its non-gaming opportunity is in the low-single digits. We believe this segment faces a different competitive set, aside from Unreal Engine, that includes Autodesk and Adobe.

Unity views core non-gaming industries in three buckets:

- Automotive, Transportation, & Manufacturing. Automotive companies, including BMW, Honda, and Volvo, use Unity’s software to design and engineer vehicles, as do manufacturing companies for physical products. Developers build designs into 3D experiences to allow internal teams to refine products prior to production and external customers to experience products before making a purchase.

- Film, Animation, & Cinematics. Unity is used by CG content creators, including Fremantle Media and Keyframe Studios, to develop short-form, episodic, and feature-length stories. Unity’s tools can expedite traditional development time because Unity is a real-time platform, meaning all departments (editing, animation, lighting, camera, sound, etc.) can begin working on a project at the same time and constantly iterate.

- Architecture, Engineering, & Construction. Architects and construction professionals, including Samsung, SHoP, and Skanska, use Unity for real-time rendering and 3D display of building environments. Unity allows for clients to experience construction projects in VR before they are built, enabling faster iteration and lower build costs.

AR/VR

The eventual emergence of the AR and VR markets provide a longer-term market tailwind to Unity’s subscription business. According to IDC, worldwide spending on augmented and virtual reality is forecast to be $18.8B in 2020, an increase of 78.5% over $10.5 billion in 2019. While the AR/VR industry is growing quickly, we’re cautious about the rate of forward growth sustaining very high double-digit levels. Even if you assume a strong deceleration in growth from 2020 levels, we believe the AR/VR industry could reach $70 billion by 2025. If we assume the same 7.5% addressable market rate that Unity sees for gaming applies to the AR/VR space, it would represent a $5 billion incremental market opportunity for Unity in five years. Importantly, the AR/VR market is a space where Unity is already a strong leader, so the company’s ability to penetrate that growing market should happen alongside the industry’s growth.

AR/VR has been notoriously slow to develop. Whether the industry follows our timeline or something even slower, the opportunity remains for Unity to capitalize on industry growth. Even beyond any near-term increase in AR/VR usage, over the much longer term, we think the company’s AR/VR TAM could be larger by many multiples of our $5 billion estimate.

Growth Market Assessment

We believe good long-term growth investments require an understanding of a company’s forward growth opportunities. We’ve previously described some of our growth framework here. Company growth opportunities often fit into three simple categories. One single massive opportunity, an old opportunity transitioning into a new opportunity, and a new opportunity that gives way to an even bigger new opportunity. In rare cases, companies find access to concurrent big opportunities that can coexist with one another. Amazon’s eCommerce business and AWS, for example.

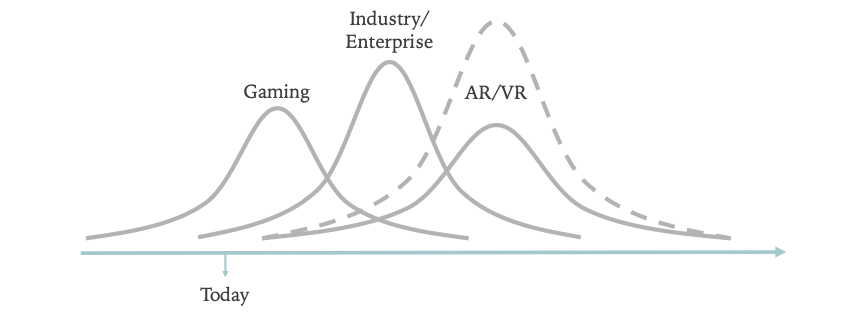

As detailed above, Unity is set to benefit from three major growth markets that should provide independent growth waves for the company. The game development software business is the most mature segment, but still likely under 10% penetrated by Unity. We think the gaming opportunity for Unity still presents significant upside as gaming and 3D content become a bigger part of entertainment and social over the next decade. Unity is just entering the early innings of a near-to-medium term opportunity in non-gaming markets, which the company views as a larger market opportunity in their estimates. Longer-term, Unity is best positioned to benefit from the tailwind of AR/VR. All things considered, the company seems to be entering a new growth curve consisting of the latter new market opportunities.

Unity’s Market Growth Curve Progression

Given the offset nature of the three curves, we believe Unity is set up to benefit from consecutive growth tailwinds that should enable the company to sustain strong double-digit revenue growth for several years on end.

What Matters for Unity

Given our belief in Unity’s product and market opportunity, we think there are two core things to consider looking forward:

- Unity’s position against Unreal Engine

- The upside case to Autodesk or Adobe status

1. Unity vs. Unreal Engine

The 3D game engine market is essentially a duopoly between Unity and Epic Games’ Unreal Engine. Unreal Engine has powered premier AAA gaming titles (Sea of Thieves, Star Wars Jedi: Fallen Order) and high-budget films (The Mandalorian). Aside from Unreal Engine, parent company Epic Games is also a game developer. The company has created popular games including Fortnite, Gears of War, and Unreal, the original game Unreal Engine was built to run. Unreal Engine is the result of Epic building software to serve its needs as a game developer and releasing it to the broader market.

Unreal Engine doesn’t charge a subscription to use its software. Instead, the company charges a 5% royalty for all gross revenue generated over $3,000. It’s likely that the company sets up unique deals outside of the standard royalty agreement for certain titles like The Mandalorian.

Objectively, there are some similarities between the offerings. Both companies have spent hundreds of millions of dollars on R&D to improve their engines. Unity has stated that over half of the company’s headcount is dedicated to R&D. Both companies offer tools for creators beyond their game engines. Unity offers its suite of Operate Solutions while Epic offers a games store to help creators distribute their content.

There are also two obvious differences. First, Epic does not offer an advertising platform to help developers monetize, but Unity does. Developers that want the most convenient advertising tie-in are better suited to Unity. Second, Epic creates games, but Unity doesn’t. Game developers who look to create games on Unreal Engine might be paying a competitor to use their technology. Companies like Google and Amazon have dealt with the issue of being a “frienemy” to developers and creators in the past without significant issue. We suspect Epic can navigate this position without significant headwind to their business, but any company that has a competitive issue with Epic will use Unity.

The most important difference, we believe, is philosophical. Unity focuses on broad market appeal via ease of use while Unreal Engine focuses creating the most realistic, high-quality graphics. Unity CEO John Riccitiello has said, “It’s easy to make powerful tools that no one can figure out how to use, but what’s hard is making insanely powerful tools that are easy to use.” One component of ease of use is Unity’s focus on the C# scripting language compared to Unreal Engine’s use of C++. C# is easier to learn, while C++ is more powerful and efficient.

Given this tradeoff between powerful complexity and simple usability, the 3D software development market may not be winner-take-all, just as scripting languages are not winner-take-all. Different languages cater to different use cases, but many different languages can create delightful customer experiences in their own unique way. Unity and Unreal Engine will compete for customers, but we think each serves a sufficiently differentiated use case in which coexistence is the most likely long-term future.

Given the duopoly nature of the game development software market, we expect the market should prove profitable for both Unity and Unreal Engine over the long term. Considering Unity’s core comp group, the industry should support at least 25-30% operating margins long term. We see minimal risk for a pricing war between Unity and Epic but would expect consistently heavy R&D spend to drive both products forward to better address the needs of each customer’s core customer set. Scale is the primary path to profitability for Unity.

Apple vs. Epic Games

A near-term catalyst for Unity is the on-going battle between Epic Games and Apple. Epic sued Apple in August 2020 to challenge anti-competitive behavior it believed Apple was conducting in running the App Store. Leading up to the suit, Epic added its own in-app payment system to Fortnite, which violated App Store terms. Apple pulled Fortnite from the App Store for the violation, and Epic filed suit in return. Perhaps unexpectedly for Epic, Apple followed by threatening to remove Epic’s broader developer credentials, a move that would disable Epic from updating Unreal Engine on Mac and iOS. If Epic were unable to update Unreal Engine for Apple products, developers that built apps on Unreal Engine would be forced to move to a different engine. Unity would be the most likely beneficiary in that scenario.

Epic sued to block this Apple’s action against Unreal Engine and won a restraining order. The case is ongoing.

Our current bet is that Apple will ultimately step back from the challenge to Unreal Engine as it would also hurt Apple’s developer community; however, the situation is volatile. Epic’s founder Tim Sweeney seems to be on a moral mission to push Apple to be fairer to developers, although skeptics may believe Epic wants to promote its own app store that only takes 12% from developers vs Apple’s 30%. The bottom line is that we do not believe investors are currently expecting a significant tailwind from an Unreal Engine ban. Any negative outcome for Epic vs Apple would only be upside for Unity, and any outcome where Epic and Apple find a way to coexist again would be neutral for Unity.

2. The Next Autodesk or Adobe

As long-term-focused investors, we’re most excited about Unity’s potential to become the next Autodesk or Adobe. We think Unity can build a subscription business similar to Autodesk or Adobe as 3D interactive and immersive content becomes the de facto platform for creative individuals. When building out the case to become the next Autodesk or Adobe, we’re taking the conversative approach and basing our argument only on SAAS subscribers. Anything that Unity builds in its Operate business would only be additive.

While Unity reported 1.5 million monthly active creators in its S-1, not all of these creators are paid subscribers. The company stated that about two-thirds of its Create revenue came from Pro accounts. Pro accounts currently cost $1,800 per year for new users, as the company recently announced a price increase of 20 percent for new users.

We estimate Unity had 200-250k paid subscribers based on the last four quarters of Create revenue and an annual average revenue per subscriber of somewhere around $880 (excluding associated Operate revenue). By comparison, Autodesk has 4.87 million subscribers and an annual ARPS is $704 as of January 2020. We believe Adobe had over 18 million subscribers as of late 2019 with an annual ARPS to be $406.

What would have to happen for Unity to reach Autodesk or Adobe status on subscriptions alone? We present two hypothetical scenarios.

In order for Unity to reach an Autodesk-like subscription revenues over the next 10 years, the company would need to add ~3.3 million paid subscribers. In the S-1, Unity estimates there are 15 million potential creators within gaming alone. If Unity could convert 10% of those creators to paid subscriptions, it would add 1.5 million to its existing subscription number. If Unity could convert 20% of Autodesk’s subscribers, many of whom operate in Unity’s target non-gaming verticals, that would add ~1 million subscribers. Finally, AR/VR could add the remaining 800k subs to reach the 3.3 million hurdle. If Unity reached two million+ paid subscribers, it’s likely the company’s valuation would be well above that of Autodesk today as the incremental subscribers would drive additional Operate revenue beyond the subscription fee.

In order for Unity to reach Adobe-like subscription revenues, the company would need to add ~10.1 million paid subscribers. In order to get there, Unity could add 4.5 million paid subscribers in gaming. That would represent 30% of the total market today, but we expect the number of game developers to grow alongside the gaming industry over the next decade. Unity could add 2.5 million paid subscribers in industries outside of gaming (half of Autodesk’s 4.9 million) and an additional three million subscribers from the emergence of AR/VR as a next-gen computing platform to reach the ~10.1 million Adobe target. While this user growth isn’t likely to happen within the next 10 years, we think the tailwinds behind the company make this a possibility over the next 10+ years.

Conclusion

Overall, we remain bullish on Unity as the next great creative software company coming out of its IPO. The company is benefitting from three major tailwinds: first, the overall growth of gaming and its emergence as a “third place” which is driving both subscribers and advertising revenue; second, the adoption by industries outside of gaming who want to build immersive, interactive experiences; and third, we’re seeing the early emergence of AR/VR as the next-generation computing platform.

In addition to these macro tailwinds, the company has a strong product in a duopoly market that should achieve attractive operating margins in the future. The company has carved out a competitive position as the easiest-to-use tool that will serve the mass market and can co-exist with Unreal Engine. Finally, Unity has a strong management team with experience running a public company (CEO John Riccitiello was previously CEO at EA). The team understands how to talk to investors and manage the expectations of the public markets.

For patient investors, we continue to believe Unity has the potential to be the next Autodesk or Adobe. As the world continues to embrace interactive and immersive experiences over the next decade, Unity is well positioned to be the engine that underpins that future.

This note corrects a previous version that included old estimates of Unity and Adobe ARPS.