When asked in a recent interview with Germany-based Axel Springer Media about a possible merger with a traditional car company, Elon Musk said, “I suppose if there was a friendly one, if somebody said, ‘Hey, we think it would be a good idea to merge with Tesla,’ we’d certainly have that conversation.” Which automaker would Tesla most likely acquire? The answer is likely no one, based on any one of the five philosophical differences between Tesla and traditional auto (outlined below).

Musk doesn’t want to acquire an automaker, but maybe their assets

We don’t believe Tesla is open to acquiring an automaker outright, which would bring with it philosophical differences, along with financial liabilities (pensions). That said, we believe the company is open to acquiring assets of automakers, most notably, manufacturing facilities and workforces. It’s more difficult than most realize to build a plant and hire and train a workforce from the ground up. This would help solve Tesla’s primary problem, which is building enough vehicles to meet the expected 40% plus annual growth in demand.

Tesla has the means to acquire automaker assets

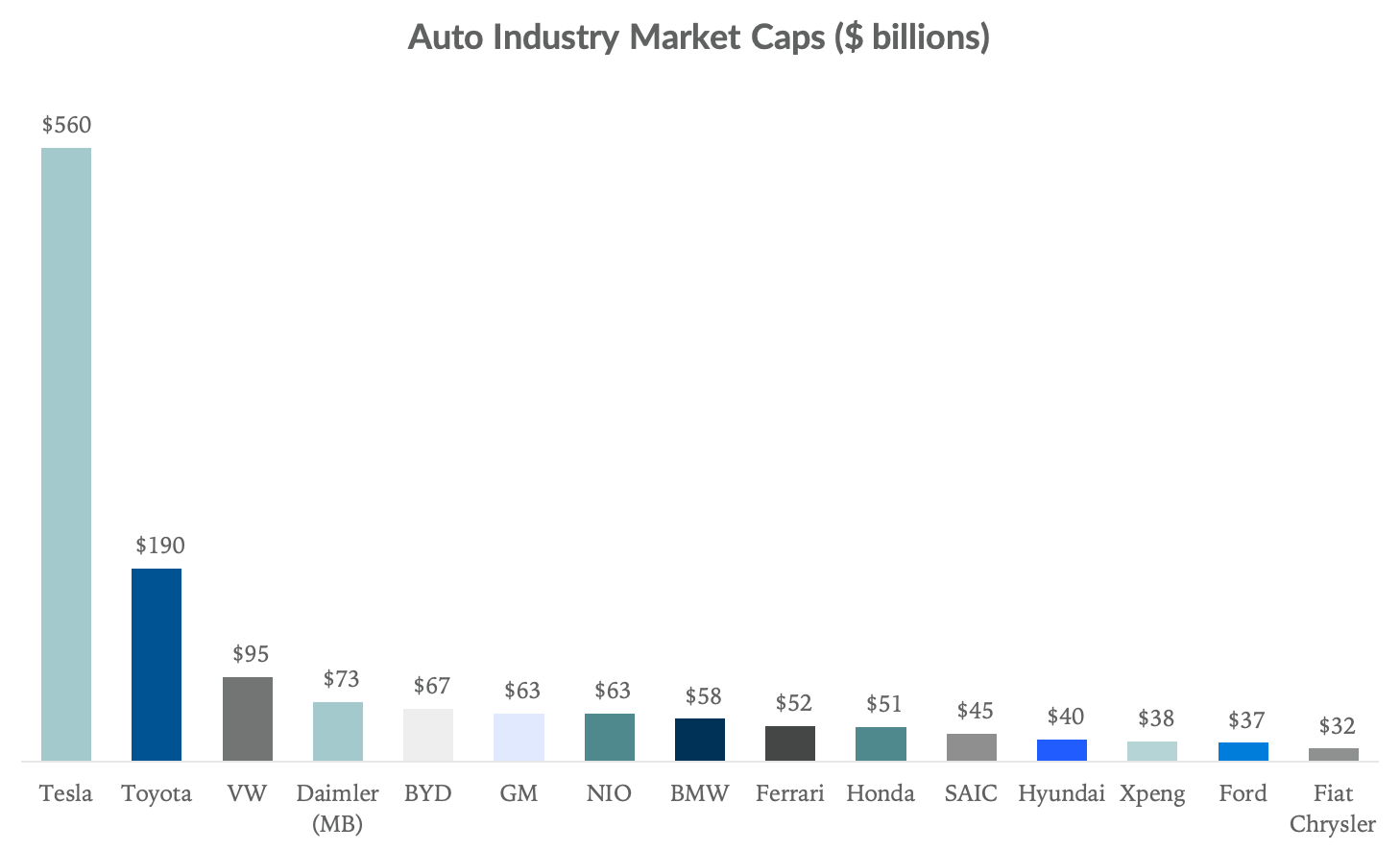

Tesla will have no problem acquiring the assets of another automaker. In fact, the company’s current market cap of $560B is greater than the combined valuation of the next six automakers. The chart below outlines current valuations:

Tesla’s philosophical differences

- “First principles” approach. Elon Musk is a believer in first principles. This approach maintains that understanding a topic’s fundamental principles yields the best path forward. It discounts the way things have been done in the past, and emphasizes finding new methods by stripping a process down to its most basic elements, and building a solution up from there. The most obvious example is EVs themselves, which represent a more efficient and sustainable way to move people around compared to traditional internal combustion engines. We mentioned earlier that Tesla is open to acquiring assets of automakers, including factories and workforces. That said, this is suboptimal, traditional auto uses Henry Ford’s manufacturing line as the primary method. Tesla, on the other hand, has created a hybrid manufacturing line that factors in assembly sequencing to dramatically optimize line speed.

- Vertical Integration. One factor in Tesla’s success has been vertically integrating hardware, software, and manufacturing. Tesla is the only car company that fully embraces this approach, designing its software to be optimized for its hardware and even manufacturing machinery for the manufacturing process itself. They’re taking vertical integration to an extreme. The outcome of this approach is a lineup of cars that are winning US EV buyers over, yielding an 85% market share. Vertical integration is at odds with traditional auto, which relies on a network of suppliers to provide commodity components, along with oftentimes outsourced software engineering.

- Tech. We struggle to identify a carmaker that has technology that Tesla would want. The company has a tech advantage in each building block of the car of the future, including batteries, software, motors, and autonomy. A highly unlikely scenario in which Tesla may want technology that’s currently held by a competing car company would be Tesla having a change of heart around LiDAR’s place in autonomy.

- Brand. Today, Tesla’s brand resonates with forward-thinking car buyers who are wealthy. In the future, the brand will expand and incorporate any future-focused car buyer as Tesla moves down market with the Model 3 and eventually launches the even more affordable Model 2. Over the next ten years and beyond, the brand will evolve outside of auto and represent a next-generation energy company, as Tesla repurposes its core auto technology into new markets, including energy capture and storage, HVAC, insurance, and even experimenting with flying taxis. It’s not all bad news for the auto industry’s brands, given GM and VW have made progress with EVs recently. In fact, Musk has been publicly friendly with VW Chairman Herbert Diess over the company’s advancements with EVs. Despite these public comments, we believe Tesla still has reservations about VW given the company’s 2015 emissions scandal, which was viewed by some inside Tesla as a betrayal against the clean energy movement.

- Sales Channel. Tesla believes most consumers in the future will buy cars online. This is a better experience compared to a dealership because it allows buyers to configure and order the exact car they want in a no-pressure, price transparent environment. By contrast, traditional auto sales rely on a dealership network model that favors large inventories, i.e. expansive car lots. Typically, this sales model employs pressure-based tactics optimized for same day closings by having enough vehicles in stock that are close enough to what buyers are looking for. One measurable advantage of the dealership network is its capacity for vehicle maintenance. This is important given Tesla will likely grow vehicle deliveries 40% annually over the next few years, and its vehicle owners are on track to face service and maintenance delays. Currently, about 80% of Tesla repairs can be done outside of a physical service center through Mobile Service providers or remote software updates. Acquiring traditional auto workforces and maintenance centers could help alleviate bottlenecks.