Tesla’s March deliveries are representative of a true growth story. The company appears to be entering into the slope of its growth S-curve. We believe the reason this is happening is a combination of consumer willingness to purchase EVs, along with Tesla’s winning formula of vehicle performance and value. For the March quarter Tesla delivered 185k vehicles, above consensus estimates of 168k and further above investor expectations of around 160k.

Entering the slope of the S-curve

A signature signal of a growth company is an acceleration in growth. This is rare, given this step up in velocity is increasingly difficult off a growing base. Of course, a company can still be in growth mode without this acceleration; however, when this dynamic appears, it’s noteworthy because it’s rare.

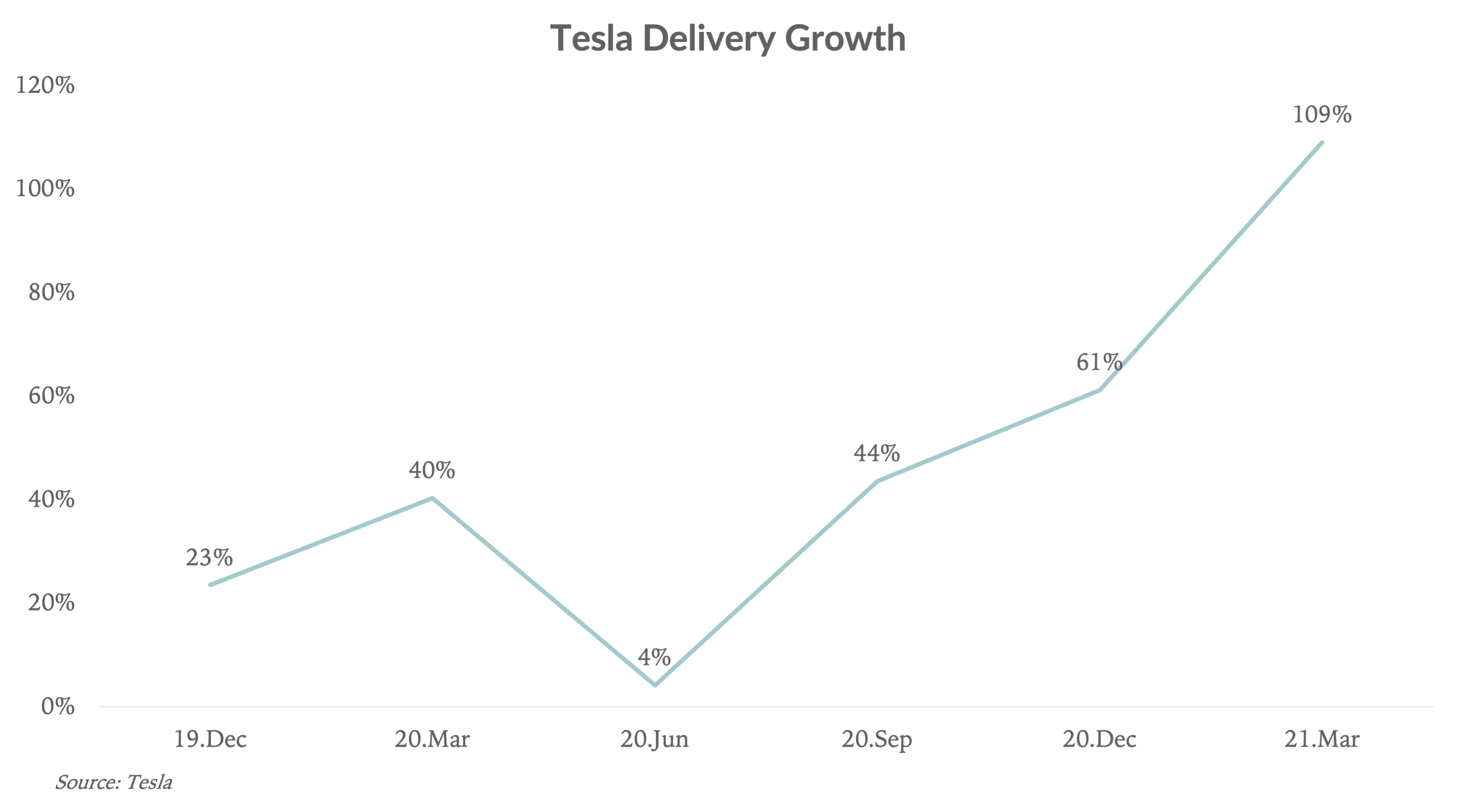

The chart below illustrates Tesla’s accelerating delivery growth over the past six quarters, with 23% delivery growth in Dec-19 climbing to 109% in the most recent quarter. Due to pandemic shutdowns, results in the Jun-20 quarter should be taken in context.

In plain English, something bigger is going on, which we believe is the combination of consumer readiness for EVs, along with Tesla’s value proposition.

Putting March deliveries into context

The 109% growth is impressive given there were more headwinds than tailwinds in the quarter. The one tailwind was that the Fremont factory was shut down for a week in the March 2020 quarter due to the pandemic, thereby benefitting year-over-year growth. In contrast, Tesla deliveries were negatively impacted by two headwinds:

- Model S and X deliveries dropped to 2k because of the model refresh. Normally S and X deliveries are around 15k per quarter.

- Some US buyers, which accounted for about 50% of the company’s revenue in the December quarter, likely delayed purchasing in anticipation of a potential $7,000 Tesla EV tax credit as part of President Biden’s infrastructure plan. A $7,000 credit is a measurable factor to take into account, as it would represent an 18% discount on a typical Model 3 purchase.

Model Y’s success in China

Aside from the macro factors, a driver of the accelerating March deliveries was Model Y in China. Skeptics will attribute Model Y’s March success as one time in nature given the pent-up demand for the new vehicle in China. While Model Y benefitted from this pent-up demand, the SUV category still remains largely untouched for Tesla, representing some 40% of passenger cars globally.

Some context relative to other automakers

As a point of comparison to Tesla’s 109% delivery growth, other automakers have reported March delivery growth between 1% and 28%, or on average, 15%. Tesla’s delivery growth outpaced traditional auto by 30%-60% over the June, September, and December quarters, which means the gap between Tesla and its competitors appears to have widened in the March quarter. It’s important to note that this comparison has a flaw, in that it compares Tesla’s global numbers to other automakers’ US deliveries. While this inconsistency muddies the comparison, we think the trend is still representative.