As investors, we review thousands of company decks every year. Often times, we underweight the total addressable market (TAM) slide, given every company seems to advertise a massive TAM. We’ve lost some faith in said company’s ability to reasonably estimate their addressable market. One of these markets is transportation, which is in the early stages of a comprehensive disruption as it shifts toward electric, software and machine-driven, and mobility-as-a-service. The below exercise is our attempt to estimate three segments of the transportation opportunity: the new vehicle market, trucking/logistics, and ride-hailing.

The new vehicle market

We estimate the global market for new vehicles, including cars, light trucks, commercial vehicles, and semis, is about $2.8T.

EVs currently account for 3% of global new vehicle sales. We believe over the next decade that number will reach 50% plus, and represent outsized opportunities for EV-first automakers such as Tesla, Nio, Rivian, and possibly Apple, along with traditional OEMs that successfully pivot their vehicles and brands to electric.

Trucking/Logistics

The total global logistics market is typically calculated as a percentage of GDP, with annual estimates pegging the number around 10%, or just over $9T. Within this market, we focus specifically on trucking, as we believe it represents the most disruptable segment in the near term through electrification and autonomy (rail and maritime will follow). Trucking accounts for roughly 40% of the total logistics market, or about $3.8T. Within trucking, there are two primary verticals: the asset-light segment, comprised of third-party logistics (3PL) such as brokerage services, and the asset-heavy segment, which involves owning and managing fleets of semis and large trucks.

Loup estimates the asset-light vertical accounts for ~25% of revenues (about $1T), with that percentage expected to continue moving higher over the next decades. This vertical is highly fragmented. Looking at the US alone, C.H. Robinson is the market leader with around 10% share, followed by multiple companies with 5% share or less. For perspective, Uber Freight did just over $1B in revenue in 2020, which represents about 0.5% of the asset-light trucking market in the US alone. Putting it together, we believe 100% of the asset-light vertical is addressable by tech-native companies, including Uber and Tesla.

The asset-heavy vertical accounts for the remaining 75% of the global trucking market. Steep investment costs associated with building and maintaining a fleet advantages incumbents, meaning this segment will take longer to disrupt. In the short term, we estimate about 10% of the asset-heavy vertical is addressable by newcomers. That said, in the long run (decade-plus), the entire asset-heavy vertical will be disruptable by autonomy-focused and software-centric transportation companies such as Tesla. As a preview of this shift, in the company’s December earnings call Musk said he expects trucking will be the first transportation segment to achieve full self-driving – long, predictable highway miles are ideal for autonomy.

Ride-hailing

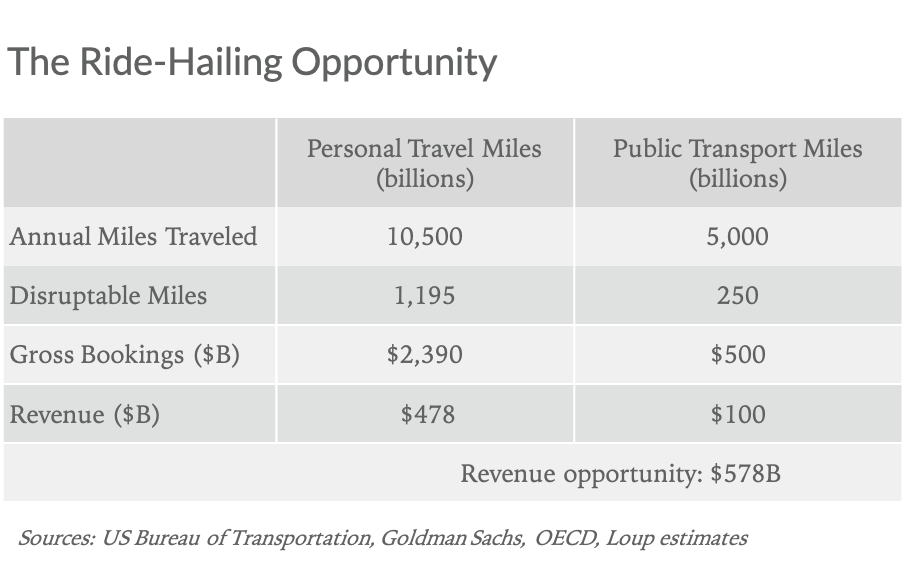

Ride-hailing is an area that receives massive TAM estimates. We do our best to make a middle-of-the-road to conservative projection. Per the OECD and Goldman Sachs, it’s estimated about 15.5T inland miles (ex. rail) are traveled globally per year. Of these, about 65% are personal vehicle miles, 34% are public transport, and just over 1% are rental car or ride-hailing miles.

Looking specifically at the personal miles segment, the US Bureau of Transportation estimates 70% of total vehicle miles (TVM) in the US are urban and 30% are rural. We assume this mix is more or less similar across the world. In the near term (pre full autonomy), we believe 15% of urban miles and 3% of rural miles are disruptable by ride-hailing companies. On the public transport side, we assume 5% of all miles are disruptable. We believe personal vehicle miles are more disruptable than public transport miles, as their higher cost per mile structure ($0.55 versus $0.20) makes ride-hailing a more attractive substitute.

Combining these two segments, we estimate there are roughly 1.45T disruptable miles. At an average price of ~$2.00 per mile for platforms like Uber and Lyft, this implies potential gross bookings of nearly $2.9T.

We assume an average take rate of 20%, leading to just under $580B in total revenue addressable for ride-hailing companies. For context, pre-pandemic, Uber did about $65B in gross bookings and $16B in revenue in 2019.

This is a near-term estimate and is therefore meant to be more conservative. In the long term (10 years plus), we expect full autonomy will be widespread and fundamentally alter the ride-hailing value equation by drastically lowering per mile fares. This will in turn increase consumer demand. Eventually, we believe autonomous ride-hailing services that are running nearly 24/7 will make owning and operating a vehicle more expensive for many urban residents than simply subscribing to mobility services. In this scenario, we expect many people who had previously owned a car will not, and those with two vehicles will shift to owning just one, thereby further expanding the ride-hailing addressable market.

Smartphone market comparison

We looked at the size of the smartphone market to put the transportation opportunity into perspective. Using 1.4B annual unit sales with an ASP of $310, we estimate the global smartphone market is about $450B. That’s the size of the current market. What could the market become? There are approximately 3.5B smartphone users globally, implying a 45% penetration rate. We believe eventually 75% of the world’s population, or 5.7B people, will be smartphone users. Assuming an average 1.2 phones per user, with an average life cycle of 3 years per phone, this implies about 2.3B annual unit sales. At an ASP of $325, this implies a $750B market.

While the smartphone market is large, it’s dwarfed by the transportation opportunity. We believe the size of the transportation market is one reason why Apple appears increasingly serious about making a car.

Will Apple enter transportation?

While a large TAM is a necessary condition for Apple to enter a market, it’s not a sufficient condition. Guided by previous commentary from Tim Cook, we identify three criteria that must be met for Apple to enter a market:

- Ability for vertical integration. The opportunity to bundle its hardware, software, and services is a necessary condition for Apple to enter a new market. We view the car of the future as electric, autonomous, and an emphasis on in-car entertainment. With experience in batteries, operating systems, cameras, design, and services, we believe the vertical integration condition is met.

- A massive market. As the above exercise illustrates, simply taking three segments of transportation yields a multi-trillion dollar market. Check.

- A profitable market. TBD. Historically, the automotive industry has had thin operating margins (mid-single digits). Over time, Tesla has the goal of achieving tech-like margins, in the 20% range. To achieve this, we believe software subscriptions for features such as FSD and in-car entertainment, along with a robotaxi fleet, will be necessary. If Apple succeeds in making Apple Car, we believe Apple would have a similar opportunity to augment its vehicle hardware offering with high-margin revenue from software and services.

While Apple would not be the first mover in these segments of the transportation market, they would have the cash and expertise around hardware, software, and services to be a potential long-term winner.