- We’re positive on iRobot long-term and believe it is one of the most investable robotics companies today.

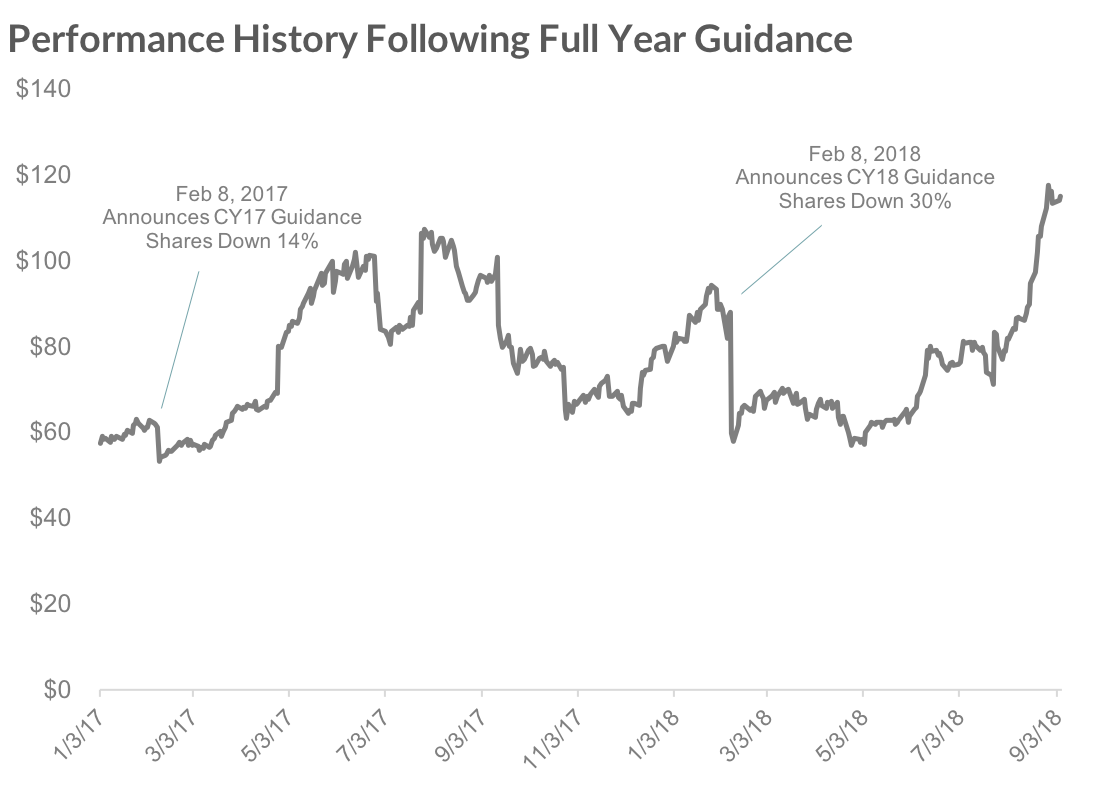

- Even though IRBT is at an all-time high, shares experienced pullbacks of 14% in 2017 and 30% in 2018, with sell-offs triggered around annual guidance.

- At a $2.9B valuation today, we expect further upside to shares going into the Sep-18 results but caution that investors should brace themselves for the CY19 annual guidance, likely next February.

- The good news is these concerning stock swings tend to be predictable and temporary.

We launched coverage on iRobot in Oct-17 and highlighted it as one of the most investable robotics companies. Over the last year, the stock saw one short-term pullback early on when the company released CY18 guidance below Street expectations. Since reporting better-than-expected Jun-18 quarter results and raising full-year guidance, iRobot shares are up 49% and are now trading at all-time highs. Driven by an anticipated better-than-expected Sep-18 quarter and new product releases, we see further upside still to come. Longer-term, we continue to see iRobot as one of the best pure-play robotics companies. To help better understand iRobot’s opportunity, below is our handbook for iRobot over the next 12 months and beyond.

Looking back at the past two product cycles

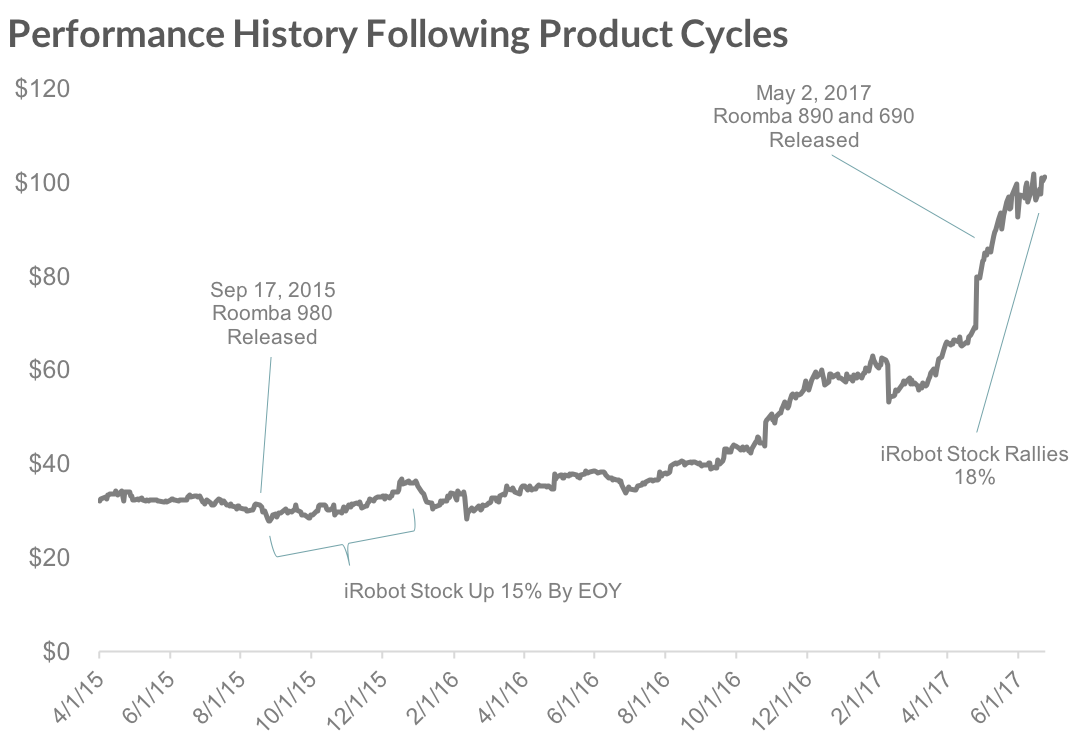

Historically, there has been a high correlation between iRobot’s stock price heading into and following new product releases. As shown below, following the release of the Roomba 980 on Sept 17th, 2015, iRobot shares sold off ~7% but went on to rally ~29% by the end of the year. More recently, when iRobot released the Roomba 890 and 690 on May 2nd, 2017, shares rose by 19% through June 23rd.

Last week, the company announced their first of two new products, the Roomba i7+, which is a new high-end robovac. The i7+ has the ability to know where it’s going and remember where it’s been, as well as a new automatic debris dispensary system. We anticipate the company will next release a new high-end Braava product to refresh the 380T. Almost identical to the 980 release in 2015, shares sold off ~9% the day of the release but have since stabilized. Given the stock’s performance after past product cycles, we see shares continuing to climb through the company’s Sep-18 earnings call in late October.

Keep an eye on 2019 guidance

While confident with the next 3-month outlook, iRobot is currently trading close to all-time highs and 33x forward P/E, which is expensive compared to historical norms. Due to the stock’s lofty valuation, we see any kind of near-term hiccup as a reason for investors to sell the stock. While we don’t believe a hiccup will occur in the Sept-18 quarter, we do see some risk when the company guides for 2019 in early February.

As shown in the chart below, iRobot in 2017 and 2018 saw pullbacks of 14% and 30%, respectively, after the company announced Dec quarter results. Both were driven by full-year guidance being softer than Wall Street expectations. We have come to find out, in both cases, iRobot has a track record of guiding conservatively. However, another guide below Street expectations will likely materially impact shares again. In turn, we see some investors taking gains off the table heading into Q4 earnings.

One of the better long-term stories

Regardless of how iRobot guides in 2019, our long-term thesis will likely stay intact, and we believe iRobot will be one of the best pure-play robotic companies in the world for several years to come. Our long-term thesis is supported by the following three catalysts.

Home robotics market ripe for growth. iRobot estimates only 10% of U.S. households own a robotic vacuum cleaner, and outside the U.S., penetration rates are estimated to be considerably lower (~2-3%). However, robotic vacuum sales have been growing at a 22% CAGR since 2012, and we anticipate 20%+ growth to continue in this category through 2020 as more households adopt this technology for the first time. We believe the biggest driver of growing adoption is increasing customer awareness, which is a near-term initiative for the company.

Technology leadership. While competition is always a big concern for iRobot, we believe the past 2 years of consistent outperformance has shown iRobot’s dominance in the home robotics market. The company also has a U.S. install base of over 13M units. We view this large and growing install base as an under-appreciated asset. As a Roomba is helping the consumer clean, it is also benefiting iRobot by gathering large data sets on how the robot interacts with the world. iRobot can then use the data to train their proprietary AI algorithms and improve their robots functionality. Having access to millions of robots across the world, we believe the company will continue to build the highest performing robots on the market.

Introduction of new products. iRobot’s mission is to drive robot adoption among the consumer. Today, that primarily consists of Roombas and Braavas, but we believe the company is capable of scaling this technology across many types of other domestic robot categories like lawn mowers, security systems, etc. Given their many years of robotics expertise, as well as the proprietary data iRobot has access to, we expect the company to begin to enter new robotic categories in the coming years.

Expecting 25% earnings growth through 2022

Driven by sustained demand trends, we anticipate iRobot will see 20%+ revenue growth through 2019. As a result of their recent vertical integration initiatives, as well as scale efficiencies, we expect the company to experience modest margin expansion over this same time period. We see these three dynamics continuing through 2022, which will translate into 25%+ earnings growth and support a 25 – 30x P/E multiple. See our 5-year iRobot model here.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.