Masterworks is creating a new asset class for retail and institutional investors by offering fractional shares of artwork from “blue-chip” artists such as Monet, Warhol, Banksy, and others. Historically, this asset class has only been available to ultra-wealthy individuals with millions of dollars to invest in a single work of art. Loup invested in Masterworks in the spring of 2019.

The company recently announced its sale of Banksy’s “Mona Lisa,” which Masterworks held from October 2019 to October 2020. For those not familiar, Banksy is a living UK artist that specializes in street art. The sale delivered an annualized 32% return for investors after fees, compared to the Dow which was up 5% over a similar period.

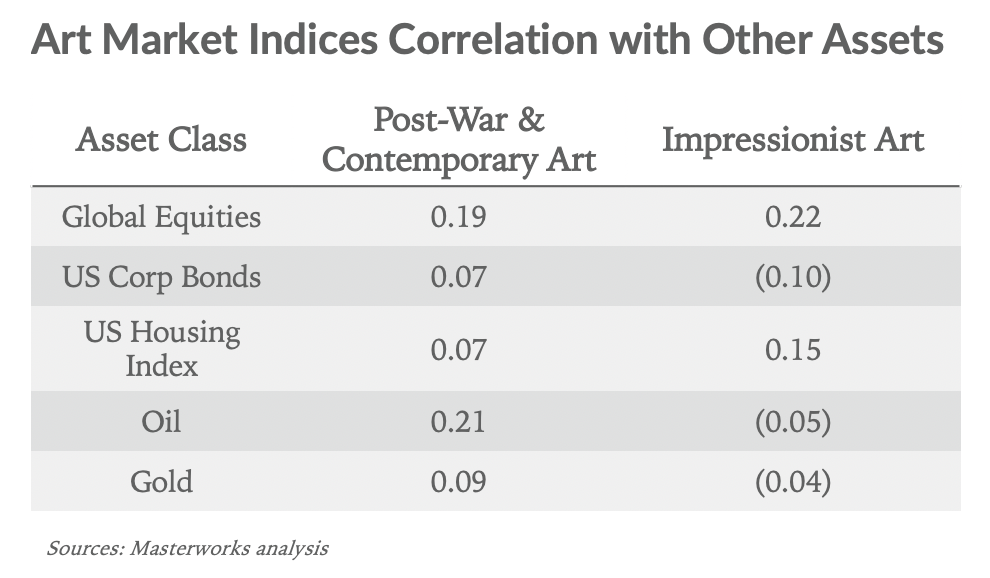

Art’s uncorrelated returns

The table below outlines art’s correlation with other common asset classes. As a reminder, correlation values range from -1 and 1, with -1 representing perfect negative correlation and 1 representing perfect positive correlation. Low correlations are values around 0. In the table below, most of the values hover around 0, which means art as an asset is not correlated to the comparison groups. Uncorrelated returns are important for managing portfolio risk, given they counterbalance typical investment classes that often have sizable valuation swings related to macro factors.

According to Masterworks’ Contemporary Art Index, contemporary art as an asset class from 1995-2020 has realized annualized returns of 13.6%, compared to 8.9% for the S&P 500, 7.0% for global equities, 6.5% for gold, and 4.1% for US housing.

Art has its critics

More specifically, investing in art has its critics. Barron’s recently published “Putting Money in the Banksy: How Investing in Shares of Art Compares With Stocks” covering the Masterworks-Banksy sale. The article acknowledged the sale’s impressive annualized returns, and yet raised a question: how does one value art? As an investment category, art has been viewed by some as more speculative compared to equities because “paintings have no cash flows or underlying asset values,” as the author points out. While this is true, art is similar to widely-accepted asset classes like gold and land, which share a non-cash flow dynamic. The criticism is understandable, given that art as an investment category has only recently been made accessible. That said, over time we believe greater liquidity and continued performance will alleviate these concerns.

The master plan: art is part of the future of finance

While it’s still early, we see Masterworks as part of the future of finance — offering investors easy access to unique investment vehicles with uncorrelated returns. Today, the platform hosts more than 30 paintings with a value of about $70m. Over time, we believe the number of Masterworks paintings could grow into the thousands, which we believe is a realistic target given last year the art market traded $85B in assets.