We believe the accelerating digital transformation will continue to drive Mac growth rates higher, and the segment will exceed investors’ expectations in 2022.

Mac accounts for about 12% of Apple’s overall revenue and was essentially flat in the five years prior to the pandemic, up on average 1% annually. Over the past three quarters, that trend has been reversed, and Mac growth has stepped up to the mid 20% range. While the segment’s growth rate will decline from those highs due to rising comps, we believe the Mac will be a source of upside for the company in 2022 given our expectation of Mac growth of 5% in FY22 compared to the Street looking for 2%. For FY23 we expect 5% Mac growth compared to the Street at down 4%. The reason for our optimism: a combination of work and learn from anywhere and a multi-year refresh cycle around the staged rollout of Apple’s new M1 chip across the Mac family.

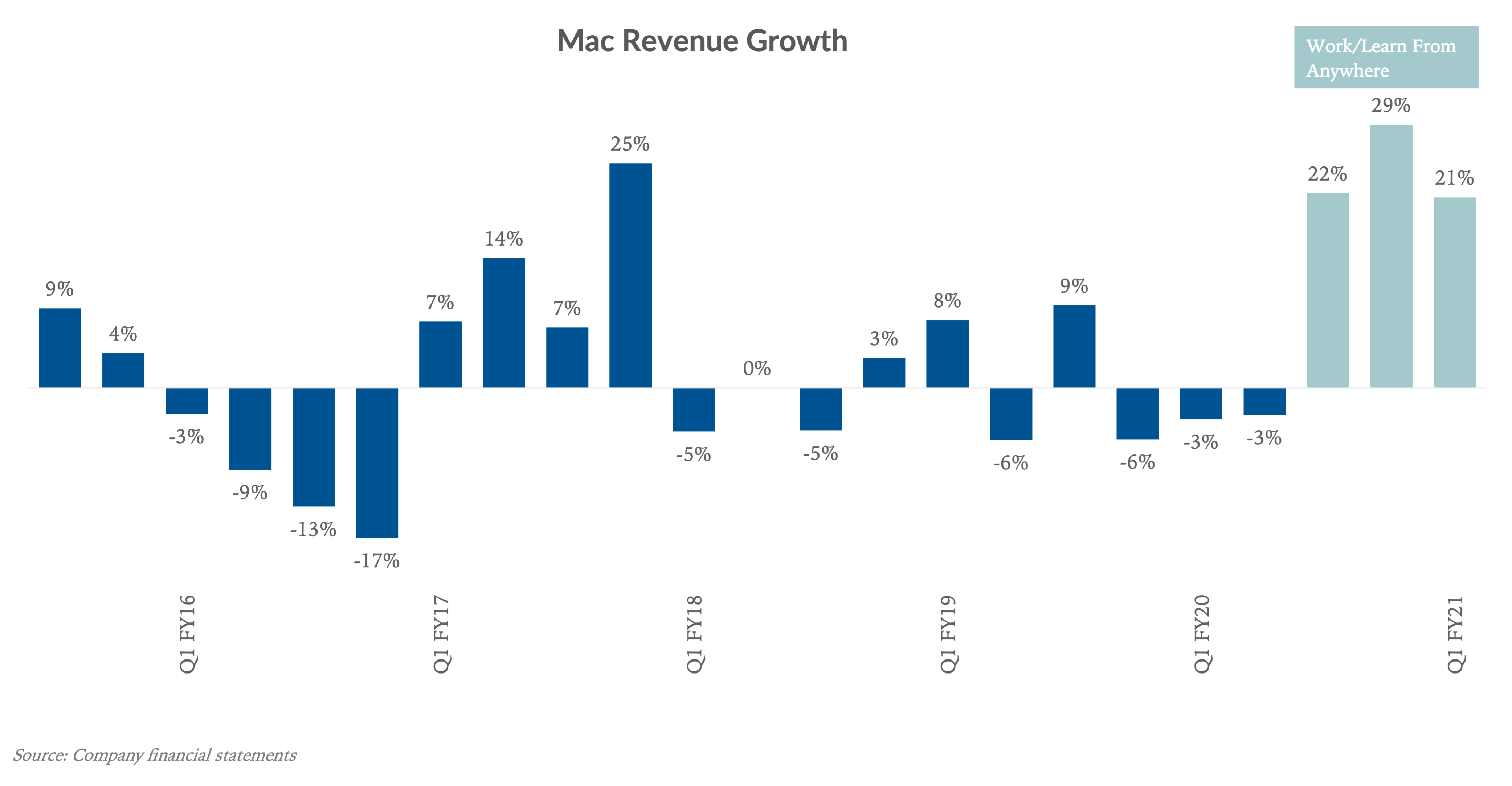

A historically lumpy business

As mentioned, in the five years prior to the pandemic (in blue), Mac revenue growth was on average flat. Since work and learn from anywhere have gained momentum, it’s been up 24% (in green). As a point of perspective, the last three quarters mark the first time since 2010 that the Mac has grown 20% plus for three consecutive quarters. We are modeling for 22% revenue growth for the current March quarter, in line with consensus estimates.

A sustained, higher growth rate

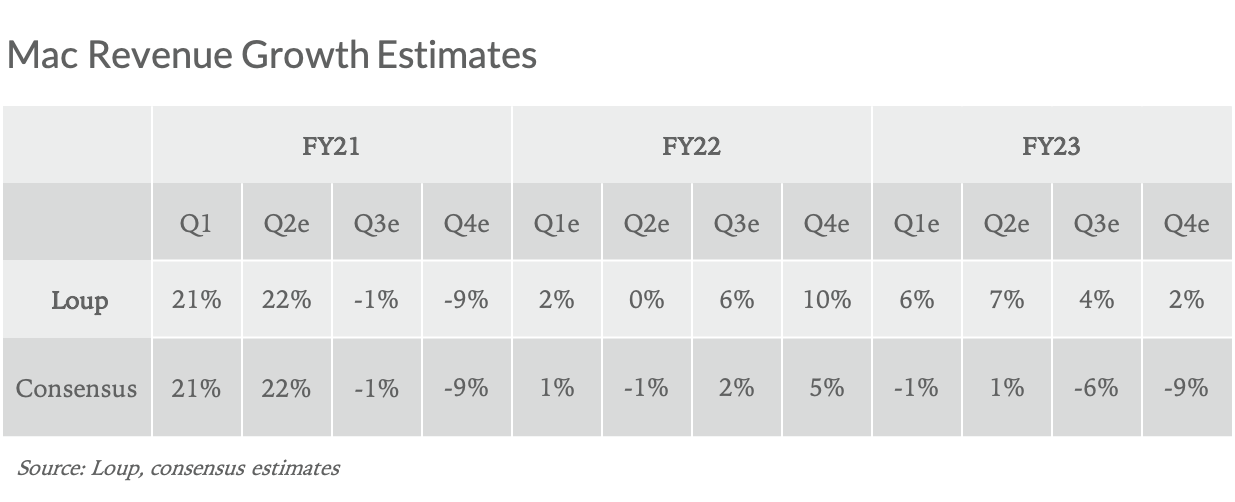

Looking forward, our FY21 Mac revenue growth estimate of 7% is in line with consensus. Beyond this year, we are more optimistic compared to consensus estimates and believe the Mac can grow 5% in both FY22 and FY23, compared to the Street at 2% and -4%, respectively. Below is a breakdown of quarterly Mac revenue consensus expectations versus Loup’s over the next three years:

Tailwind #1: Work and learn from anywhere

Despite all the talk about the digital transformation in 2020, we believe it’s still in its early stages. Although businesses acutely realized the need to digitize their operations over the past year, it takes time for broad changes and their full effects to play out. Through its hardware, software, and service offerings, Apple is the cornerstone of this digital transformation that we believe will take years to fully realize. The Mac is at the center of this movement.

Work from anywhere: Today, we estimate roughly 80% of US knowledge workers (about 1/3 of the US workforce) are working from home, which marks a change from 90% at home six months ago. Even with vaccinations and a return to greater normalcy in 2021 and beyond, we believe, long-term, 25% plus of knowledge workers will continue to work either part- or full-time remote, up from around 6% pre-pandemic. This is a revision upward from our fall 2020 estimate that 20% would be full or part-time remote. This shift is driven by greater employer comfort with remote work as productivity has remained acceptable over the past year, in part from a surge in remote workflow tools, along with video conferencing now viewed as a good alternative to many in-person meetings.

One impact of this sustained step-up in remote work is more tech outfitting for home offices. The additional ~10m full and part-time remote workers will need reliable computing hardware. While Apple products like the Mac cost on average 20% more than a comparable PC, the cost difference is justified given Macs are more reliable, require less hardware support, and tend to be more resistant to malware which can be a productivity drain. Today, the Mac has about 8% share (source: IDC) of the global desktop computing market, a figure that has been essentially flat for the past 15 years. We believe that will slowly change and expect Mac market share to inch higher in the years to come driven by the digital transformation, along with a time-tested trend: those who adopt Apple products typically remain lifelong customers.

Learn from anywhere: Over the next year we expect nearly 100% of students will return to class because students need the structure and socialization that in-person learning provides, and parents need children in school to maintain regular work schedules.

That said, now that schools have had extensive experience with distance learning, we think they’ll be quicker to turn it on in the future in the event of other public health situations like flu outbreaks or weather-related events. To prepare for these events, we expect school districts, educators, and parents to spend more on tech outfitting to ensure there is adequate infrastructure to facilitate this on short notice. This should be a continued gentle tailwind for the Mac segment.

Tailwind #2: The new M1 chip lineup

On top of the accelerating digital transformation, the Mac tailwind will strengthen from a once-in-a-decade hardware refresh. Apple started selling Macs with its internally-developed M1 silicon chips in November 2020. Typically when a major product refresh is previewed, potential buyers delay their purchases until it arrives. Despite having foreshadowed the transition to M1 in June, Mac sales in the Sep-20 and Dec-20 quarters grew 29% and 21%, respectively. The takeaway is that M1 should help sustain already strong Mac demand.

Currently, the M1 is available in the 13-inch MacBook Pro, MacBook Air, and Mac mini. We estimate these three models account for about 65% of Mac units. The rest of the Mac lineup, including the 16-inch MacBook Pro, iMac lineup, and Mac Pro, will transition to M1 silicon over the next two years. On the company’s December quarter earnings call, Tim Cook said the M1 “gives us a new growth trajectory that we haven’t had in the past.” We agree and believe the Mac will continue to get a measurable boost over the next 2-3 years from its refreshed lineup, as it offers material speed and performance improvements over the previous Intel-based Macs.

Putting it together, we believe the combination of the ongoing digital transformation and refreshed lineup are durable short-term and long-term tailwinds, respectively, that can lead to sustained low to mid-single-digit Mac growth over the next few years, which are growth rates that have eluded this segment for the better part of a decade.