- Shares of GOOGL are trading up ~3.5% after hours as the company is defying the law of large numbers, growing revenue by 26% y/y vs. 26% in Mar-18, 23% in FY17, and 20% in FY16.

- AI, for the first time, is starting to have a measurable impact on results, as evidenced by paid clicks up 58% y/y vs consensus of 49%. This is because AI makes search results more relevant, increasing paid clicks.

- The language around Waymo’s commercial rollout continues to lack detail, but other opportunities that had not been brought up on earnings calls before—such as the logistics market and licensing the technology for use in personal cars—were mentioned on today’s call.

- Our ongoing questions about potential regulation and, more specifically, the impact of the EU’s recent decision were largely unanswered. We see little impact on Google’s core business in the long run.

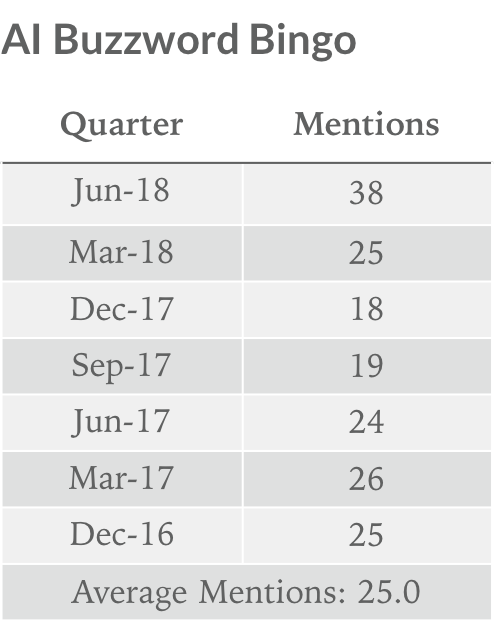

- Buzzword Bingo: Google mentioned AI/ML a record 38 times, comfortably beating the previous record of 26.

AI-first

Google has talked a lot about AI over the last 7 quarters – so much, in fact, we have been tracking the number of times they mention it on their earnings calls (see below). The company has been clear that they are an AI-first business but has stopped short of giving investors confidence that AI is actually impacting revenue and expenses. This changed on tonight’s earnings call based on the clearest examples yet of how the company is weaving AI into its existing products, as well as the corresponding expenses of doing so. Some tangible examples from the call related to AI include: driving increased relevancy in Search that shows up in the growth of paid clicks (58% vs the Street at 49%). On the expense front, higher capex reflects the increasing cost of building out data centers that can accommodate the increased computational load of millions of people using AI every day. There were non-stop mentions of AI on the call related to products like Google Translate and Google Assistant, but none that we thought could point to a tangible impact over the next year.

Waymo

While the company’s language remains measured regarding timing, it’s clear Google has a leadership position in autonomous fleets, as they begin to discuss the practicalities of a commercial rollout and other applications of the technology. These include things like licensing it for use in individually-owned vehicles and applying it to the logistics industry, but details thus far are vague. The takeaway is that autonomy remains one of the largest opportunities in tech over the next decade and Google will be one of the beneficiaries. We continue to believe Waymo could be Google’s 3rd largest business behind Search and Youtube (ahead of Cloud), given both the size of the mobility market and the potential for Google to capture a sizeable portion of it with a first-mover advantage.

Data privacy and impact of EU’s Decision

The real nemesis to the Google story is privacy concerns and regulation, which impacts their multiple. Last quarter, the company reassured investors that Search (90% of revenue) is intent-driven and does not rely on capturing personal information, which put investors at ease. However, the privacy question has been replaced with an ongoing regulatory question. The issue is not the recent $5B fine (cash balance is just over $100B) that Google is appealing, but rather the potential impact on its business policies that could result from the regulation. Sundar Pichai would not comment on the future impact of unbundling Google Play Store and Android, commenting that it is too early to determine the potential impact.

Tracking Google’s AI focus

Over the past 7 quarters, we have tracked how many times presenters and analysts have made comments about AI including instances of terms like AI, artificial intelligence, machine learning, natural language processing, or TensorFlow. This quarter’s 38 mentions included a record-high 16 mentions during Q&A, demonstrating AI’s real impact on their business, as it draws the attention of analysts.

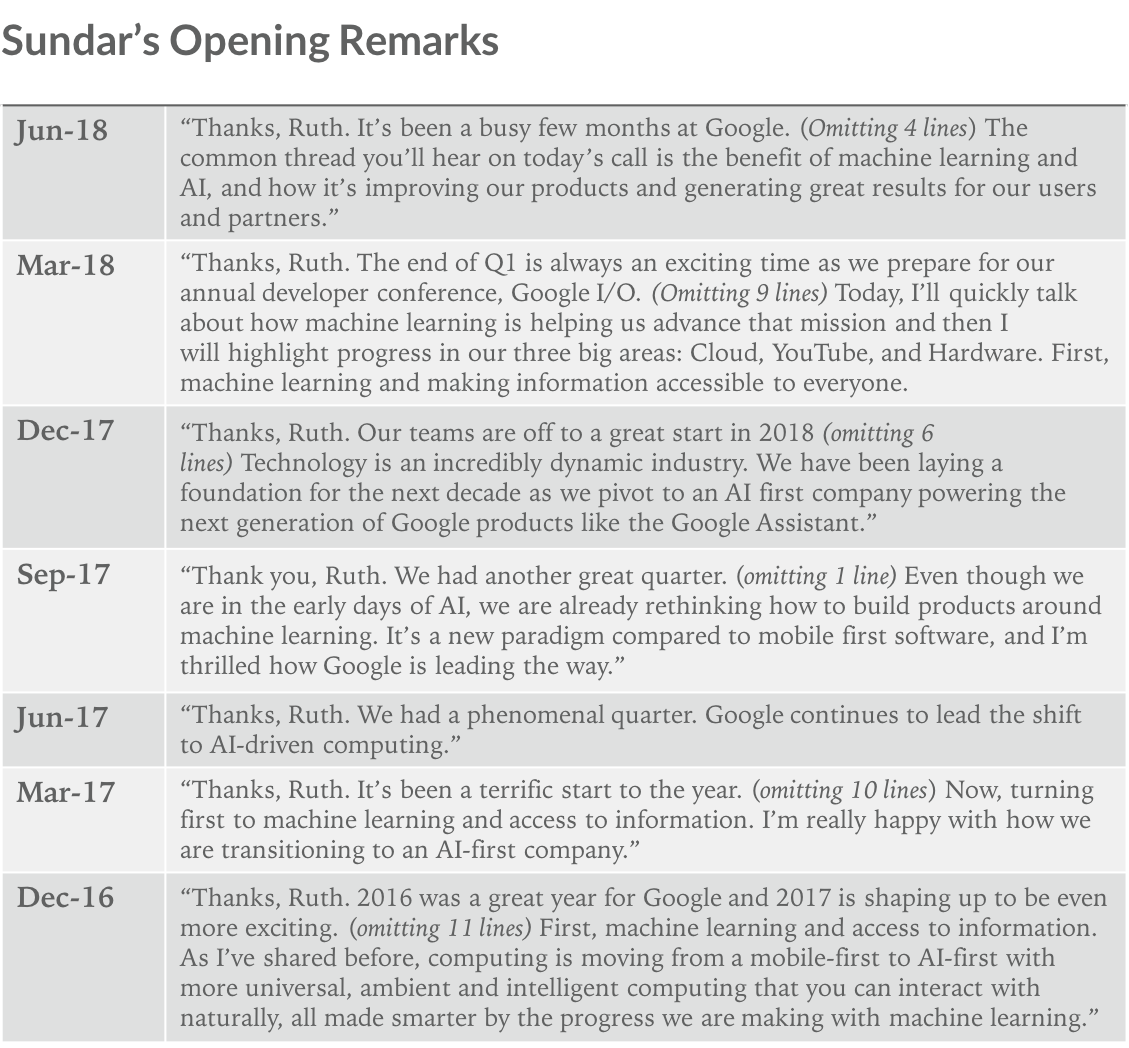

Over the same timeframe, we have noted Sundar’s opening remarks and the urgency with which he brings up Google’s efforts in AI. In each of the last 7 quarters, AI is mentioned in the first several sentences. Below is a look at his opening remarks over time.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.