The pandemic has forever altered consumer buying habits. Ecommerce trends, as measured by the percentage of total US retail spending, have accelerated.

In late March 2020, we surveyed 245 US consumers to investigate how shopping behaviors were changing as a result of the first month of COVID-19 lockdowns. We recently completed the second iteration of our survey and the bottom line is this:

- The growth in ecommerce at the beginning of the pandemic is proving sticky seven months later.

- 82% of consumers have opted to buy more online since the pandemic began, compared to 72% in March.

- 75% of people now expect to increase their online shopping moving forward, up from 60% in March.

- We continue to believe the pandemic has accelerated ecommerce adoption by 2-3 years.

Comparing November and March survey results

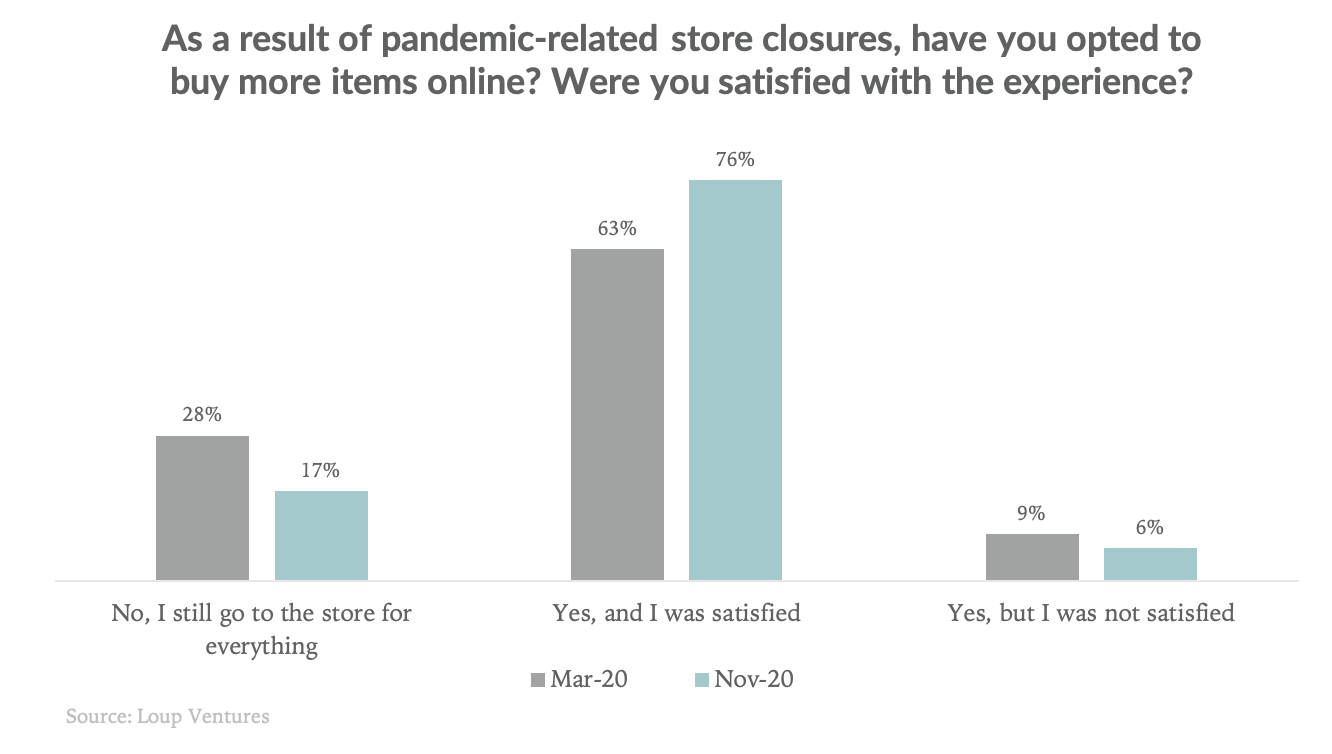

We recently asked 268 US consumers the same questions as our March cohort. We found that 82% of consumers have opted to buy more online since the pandemic began, compared to 72% in March.

76% of respondents indicated that they are buying more online and that they were satisfied with the experience, compared to 63% in March. 6% indicated that they are buying more online but were not satisfied, compared to 9% in March. Improved satisfaction rates suggest that the challenges online retailers faced in meeting fresh demand early in the pandemic have been partially resolved.

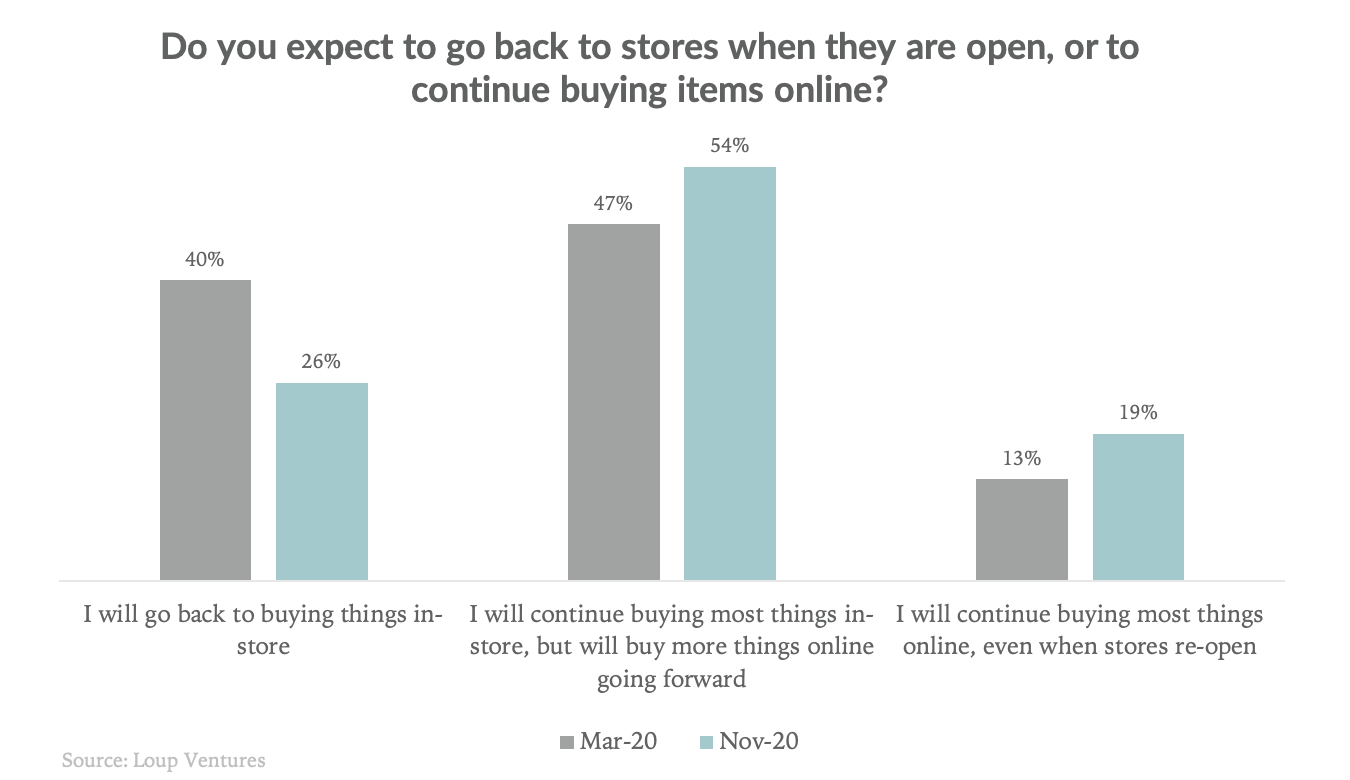

Our November survey indicates that almost 75% of people (compared to 60% in March) expect to increase their online shopping moving forward. 54% of respondents said they will return to buying most things in stores but plan to buy more online, up from 47% in March. An additional 19% said they plan to continue buying most things online, up from 13% in March.

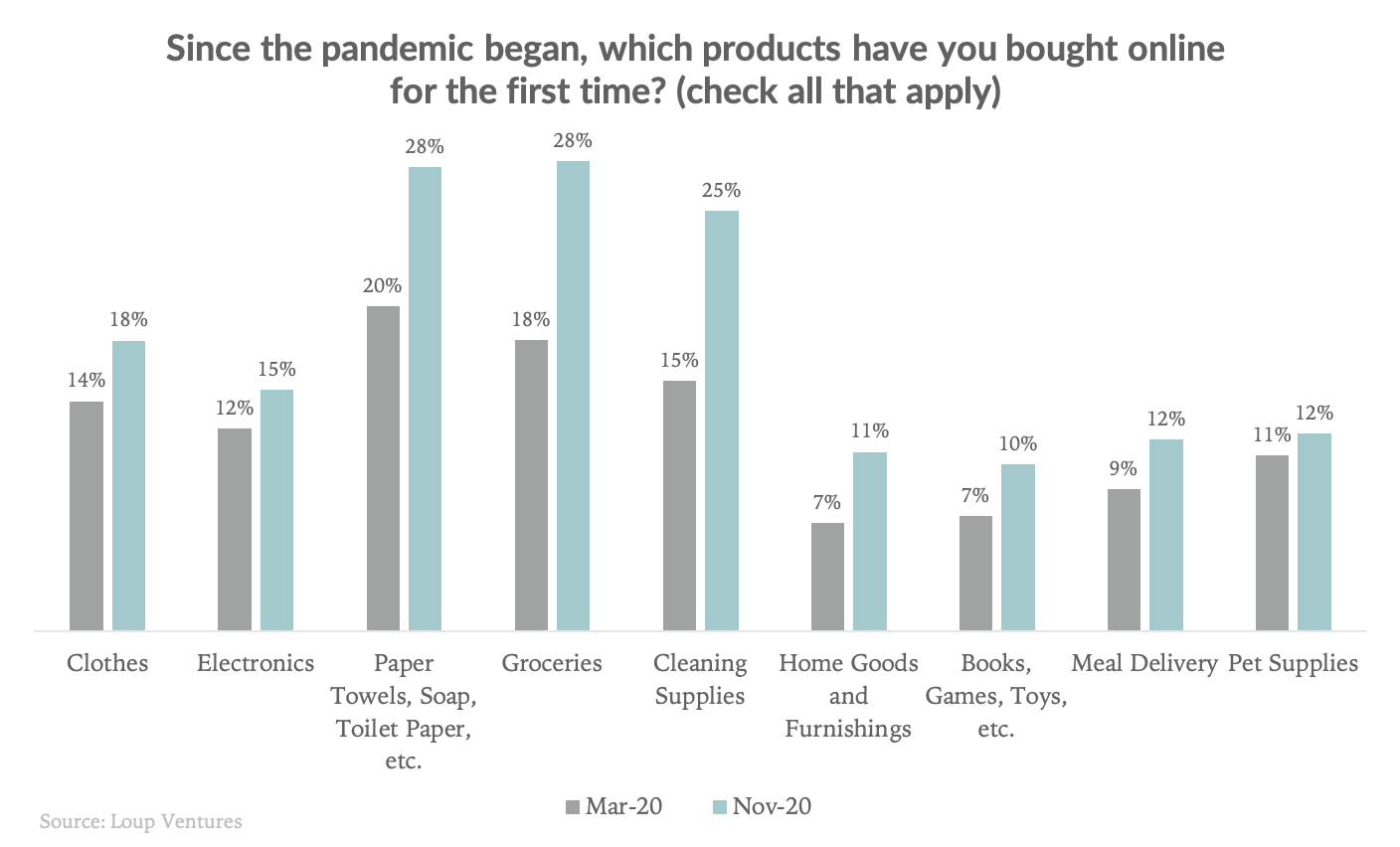

In March, we asked consumers which products they had tried purchasing online for the first time in the past month. In November, we asked consumers which products they had bought online for the first time since the pandemic began. The most popular categories in both surveys were home staples (paper towels, soap, and toilet paper) and groceries, followed by cleaning supplies.

The upward move in first-time grocery adoption from 18% to 28% suggests that consumers are increasingly looking to limit their visits to stores and/or benefit from the convenience of grocery delivery. However, meal delivery continued to underperform vs. our expectations. Consumer awareness and comfort with meal delivery will need to increase for adoption to grow.

Revisiting the ecommerce bull vs. bear case

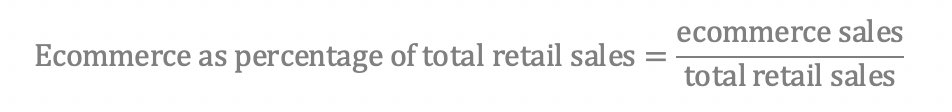

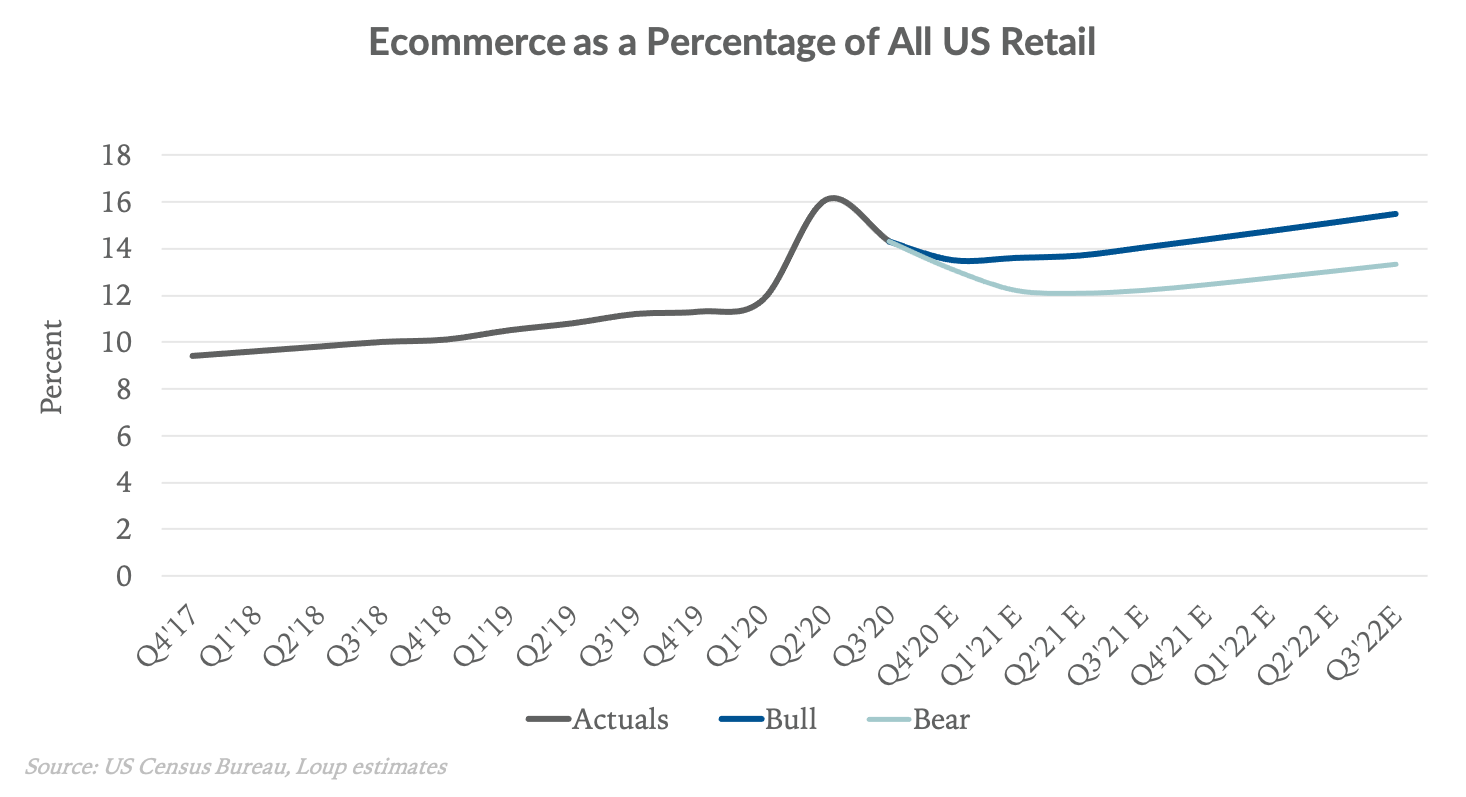

In our ecommerce survey note from March, we laid out a bull vs. bear case for ecommerce, arguing that ecommerce could represent between 21% to 32% of total retail spending in Q2 2020, before settling in the 15%-20% range in subsequent quarters.

This forecast was founded in the belief that total retail spending (the denominator in the above equation) would fall by 30% to 40% in Q2 due to widespread store closures, while ecommerce sales (the numerator) would be flat or positively affected by stay-at-home orders.

Recent US Census Bureau data have shown that our estimates were too high, as overall retail sales (denominator) bounced back faster than we expected. In Q2, total retail sales were $1.3B, falling just 4% q/q on an adjusted basis. Ecommerce sales (numerator) were $211m, growing 32% q/q. Putting it together, ecommerce accounted for 16.1% of all retail spending in Q2, up from 11.8% in Q1. If total retail sales had fallen 30%-40% as we projected, ecommerce would have accounted for about 25% of all retail spending, right in between our bull and bear cases.

In Q3, Census Bureau data show ecommerce accounted for 14.3% (adj. basis) of total retail sales, about a 2 percentage point decline from Q2. This was driven by an increase in total retail sales, which grew 12% q/q, compared to ecommerce sales which fell 1% q/q. With that data point and our recent survey results in hand, we’ve updated our bull vs. bear case below:

Macroeconomic conditions remain particularly uncertain for Q4 2020 and Q1 2021 as coronavirus cases rise across the US, leading to more store closures and partial shutdowns in some states. In our bull case, the acceleration in ecommerce trends leads to a step-function shift, pulling ecommerce adoption forward by 2-3 years. In our bear case, the ecommerce adoption rate settles in line with its pre-pandemic growth trajectory.

Regardless, we expect that over the next few decades ecommerce could approach 55% of all retail sales. This transition should serve as a long-term tailwind for retail and delivery companies that optimize the ecommerce consumer shopping experience.