Neurotech for Brain Modulation

In Volume I of this series on Consumer Neurotech, we established a framework for thinking about Consumer Neurotechnologies and their value propositions. In Volume II, we discussed neurotechnologies that have the value proposition of Control (or, using our taxonomy from Volume I, neurotechnologies whose “Effect-type” is Control). In Volume III, we analyzed neurotech with an effect-type of Feedback. Here, in Volume IV, we’ll explore neurotechnologies that directly modulate the nervous system.

Neurostimulation for Learning

Fiction

Eight squats left. Seven. Now, six. You silence the verbal monologue ringing in your head, attempting to focus all of your awareness on visualizing the flatness in your back, helping to construct the perfect angle with your upper legs as you lower yourself. You shift your focus to your feet and micro-adjust so your weight is distributed in the sweet spot, a little in front of your heel. Four squats left. You let the high-tempo electronic music take hold and carry you the rest of the way. Last one, and you put the bar back on the rack. Now you peel off your headphones—you run your fingertip over the electrodes in the band while you catch your breath. Training for your powerlifting competition is a game of masterful repetition. It can be hard to see the improvement day over day, and part of your will to continue comes down to belief in the power of addition: small improvements sum over time to noticeable changes, to heavier plates on the bar. Today, though, you notice that your squats felt meaningfully easier. The competition is in two months, and you can feel yourself on the path to your new personal record.

• • •

“Learning,” no matter which of its many conceptions we consider, ultimately comes down to cellular and molecular-level changes in the nervous system. As such, it’s reasonable to ask what would happen if we could make these changes occur more efficiently, or if we could make them more likely to occur? Below, we review one such piece of technology that takes the approach of modifying the brain at a molecular level in order to make it easier to learn motor tasks.

Halo Sport

- Medium of innovation: Hardware

- Device-type: Stimulate

- Form-factor: Headphones

- Effect-type: Neuromodulation

The Halo Neuroscience headset is a $600 neurostimulation device that uses transcranial direct current stimulation (tDCS). Halo has developed a set of headphones that feature electrodes to perform the tDCS; the headphones’ band typically sits over the motor cortex, and therefore the tDCS impacts the part of the wearer’s cortex that controls movement. According to Halo, the tDCS “primes” neurons in the motor cortex so they become more plastic—when an athlete wears the headphones before and during a workout, they can learn movements more quickly. Halo focuses their product on elite athletes who consistently train, and they’ve conducted decent studies comparing physical improvement of athletes who do and don’t use Halo’s neurostimulation. A large part of Halo’s strategy appears to be sponsoring athletes and sharing success stories. Although Halo’s primary marketing is around athletics, in this video a pianist describes the apparent benefits of using the Halo headphones while learning a new piano piece.

Takeaways

- Halo operates on a bold principle: “We run electrical current through your brain, and as a result, you learn more quickly” (our phrasing, not Halo’s). For companies like Halo that claim to enhance their users, there is a need to prove the efficacy of the product, because the knee-jerk reaction to such claims is intense skepticism. This proof can take either or both of two forms: anecdotal/qualitative and quantitative. Halo has undertaken both, through their sponsorship of influencer athletes (anecdotal/qualitative) and through conducting scientific studies of their product to provide data (quantitative).

- To the above point, an open question is the extent to which willingness to buy a consumer neurotechnology product will be based on testimonial, in contrast with scientific data. This will certainly depend on the particular product and market; as such, it’s advisable for consumer neurotechnology companies to quantitatively assess the preferences of their target audience through a survey or other methodology.

- The gold standard for evidence of product efficacy is evidence provided by a third-party. For a product like the Halo, where there isn’t much at stake in the decision to use or not us the product, this isn’t a huge deal. However, setting a precedent is important because there are technologies for which third-party verification is critical, as in the case of neuroimaging applied to lie detection, where non-commercial academic review has found significant problems with the first-party commercial claims.

- Although with this device, the risk faced by the user is mostly limited to a financial risk (which they mitigate with a 30-day satisfaction guarantee—although, is 30 days long enough to experience the benefits of the headphones?), an ethical question still arises: what responsibility does Halo or any other consumer neurotechnology company have to establish and communicate to potential users the variability in its effectiveness? With a 30-day money-back guarantee, this question isn’t all that important. It becomes more significant, though, looking forward to the distant future when invasive neurotechnology could be used for purposes of enhancement. This also bears resemblance to the developing and marketing drugs that might be toxic for some, but highly effective for others.

- Related to the point above, this inter-individual variability is going to be a marketing problem. If neurobiological and engineering constraints make it such that a product will only work for 50% of its users, reviews for the product will be highly polarized: imagine a barrage of 1-star reviews from users who see no results with Halo, and a set of 5-star reviews from athletes who’ve seen their performance improve markedly. How should Halo manage this marketing conundrum?

Use-Cases and Market Size

Athletics

Halo’s primary use-case for motor learning enhancement is athletics. To estimate the US market size, we split up our analysis between college athletes and professional athletes; it’s possible that non-collegiate and non-professional athletes would purchase a Halo, but given the $600 price-point, the inherent product skepticism, and the fact that amateur athletes usually don’t track their performance as closely as collegiate and professional athletes—we assume this market will be small, and therefore omit it from our analysis.

Broadly, we model this as [Number of Athletes] x [Market Penetration] x [Average Selling Price]. We estimate the number of professional and collegiate athletes and use the price of the Halo headset as our ASP estimate. We make assumptions for the market penetration growth curves, although our models are easily adjustable to accommodate different values for these assumptions.

With conservative market penetration assumptions, we estimate that the annual market for enhanced motor-learning will be only $500,000 for professional athletes in 2025 and $12,090,000 for collegiate athletes in 2025. Both of these numbers are smaller than the grand-slams sought in venture capital-funded businesses. The reason these markets are so small is that the total addressable market is limited—simply, there aren’t very many athletes. In order to increase revenue given the small TAM, Halo could introduce an annual subscription.

Music

Even though Halo has official marketing material around the musician use-case, we don’t think this market will take off. Musicians are probably less inclined to purchase performance-enhancing gear than athletes are; the field of athletics is already receptive to optimization (e.g. using fluid dynamics to design swimsuits), and a core principle of athletics is metrics-based competition. In contrast, music is aesthetic and appraised as art, sans quantification. We think this serves as a useful example of an important point: consumer neurotechnology products that emphasize enhancement should target markets that have an “optimization mentality.” Without this mentality, the value proposition doesn’t impress, and might even yield disdain.

Surgery

Transcranial direct current stimulation has been investigated for its utility in training surgeons. The reasoning goes: Surgeons must use fine motor control during surgery, so therefore if we make it easier for the motor cortices of surgical students to adapt to new movements, then perhaps we can train surgeons more effectively.

As of 2008, there were 136,000 active surgeons. The surgical student market is even smaller than the professional athlete market, so we assume that any company (Halo or otherwise) who wanted to enter this market with a tDCS product would need a subscription model to be profitable. Given that there are 141 medical schools in the U.S. and generating a back-of-the-napkin estimate for the number of surgical students per medical school (based on other statistics), in addition to estimating the ASP to be the price of the Halo headphones and estimating an annualized subscription cost of $300/head/year, our estimates show the 2025 market to be only $520,000.

Each of the markets we’ve covered have been, by themselves, fairly small. The Halo device and its particular constraints and business models represents only one take on a broader concept: upregulating human learning. Halo tackles the learning of movements; one can imagine future neurostimulation technology that makes it easier to learn to recognize visual patterns (helpful in e.g. pathology or radiology) by stimulating the visual cortex. We could further envision the upregulation of even higher-order learning—in a sense, we already have “technology” that does this: caffeine. Even though our projections have Halo’s markets as potentially small, the sheer number of domains where human learning is relevant (and the size of the academic and professional education markets) makes for a large opportunity.

Neurostimulation for Affective State

Fiction

Every Wednesday, it seems you rediscover the meaning of “Hump Day.” That mid-week hump hits right around 3pm—emerging from the food coma, you dwell on the thought of still having two days left before your severely-needed R&R. And that’s not even thinking about the essay you promised you’d edit for that friend who decided to apply to grad school after a decade in the workforce…and how is it, again, that you’ll finish the 20 more slides on this presentation before going home? Coffee is an option, but you’ve already had two cups today and you feel yourself approaching addiction. You sit for a few minutes and think, willing the haze to clear slightly so you can arrive at a plan of action. Suddenly, it dawns on you. You reach into the left drawer on your desk and fumble around with your fingertips for a few seconds, searching for the pod-like shape among the sea of pencils and dangerous papers eager to doll out paper cuts indiscriminately. You grab the device, pull it out, and nestle its curved adhesive pad onto the matching curvature midway down your neck. After opening the companion app, and setting the Energy intensity to level 7, the tingling underneath the adhesive pad starts to kick in. Sixty seconds later, you peel the stimulator off, return it to its home quickly, and crisply close the drawer. As you pull your chair up closer to your desk with a game-face on, you think you might be feeling slight butterflies about getting to give this presentation to the CEO tomorrow.

• • •

One obvious direction for neurotechnology to explore is that of modulating emotion and physiological state. We refer to these collectively as “affect modulation,” although we acknowledge this terminology doesn’t capture the difference between emotion and its physiological manifestation; rather, we operate under the assumption that physiology may be used to deduce and modulate emotional state. In the above scenario, we describe what it might be like to one day use a consumer-available neurostimulation device that generates a sense of energy.

Here, we’ll discuss two examples of devices that aim to achieve affect modulation through neurotechnology (we’re exclusively considering technologies that do this by electrically stimulating the nervous system; importantly, we aren’t considering ingestible substances like caffeine and other drugs).

Nervana

- Medium of innovation: Hardware

- Device-type: Stimulate

- Form-factor: Headphones

- Effect-type: Physiological

The first product is called Nervana, a non-invasive vagus nerve stimulation device that claims induce a sensation of relaxation and calm. The device, which costs $300, synchronizes vagus nerve stimulation with audio of the user’s choice: the user plugs their phone, MP3 player, etc. into the Nervana Generator using an audio jack, and the Generator outputs to Nervana’s headphones, which contain electrodes in the earpiece to provide electrical stimulation to the user. We want to note that Nervana provides no scientific data about the effectiveness of their product, so we have no idea if it works or not; we’re including it since it’s an interesting concept.

Thync (no longer sold)

- Medium of innovation: Hardware

- Device-type: Stimulate

- Form-factor: General Headset

- Effect-type: Physiological

The second device for modulating affective state was manufactured by Thync. Thync is a non-invasive neurostimulation company. Their original product, the Thync Calm and Energy Wearable, was intended to evoke sensations of energy or relaxation. Their second product, the Thync Relax Pro, was specifically focused on inducing sensations of relaxation. According to their website, Thync has since pivoted into treatment of psoriasis, an autoimmune skin condition, for which they’re conducting clinical trials and will pursue FDA clearance as a medical treatment. Our discussion here will be limited to the non-medical uses of the original two Thync devices. It’s unclear from public information why Thync pivoted, and therefore it’s difficult to take lessons from it.

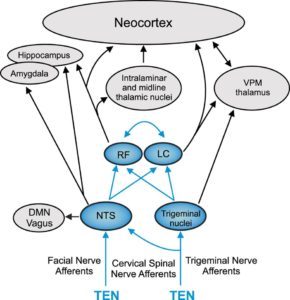

The Thync device, at least for the relaxation mode, works by stimulating afferent fibers of the facial and trigeminal nerves, as well as cervical spinal nerves (C2/C3). The device used an adhesive pad to stick a stimulator to one side of the user’s forehead (facial and trigeminal nerves) and an additional electrode attached to the back of the user’s neck (cervical spinal nerves). According to research published by Thync in the journal Nature, their neurostimulation technique has downstream effects on the physiological mediators of stress. For those savvy with neuroanatomy and neurophysiology, this diagram from the paper delineates a possible pathway for the stimulator to achieve its effects. Note that “TEN” stands for “transdermal electrical neurosignaling,” which is the fancy name Thync uses to distinguish its technology from other neurostimulation techniques.

The original device cost $200, although the adhesive strips cost more (we aren’t sure what the specific price was). The Relax Pro cost $150, with a $30 monthly subscription to continuously send users the adhesive pads. Note that neither of these devices are available anymore—the reviews we’ve found are from early 2017. In terms of efficacy, reviews like this one from MIT Technology Review note that the original Thync devices worked for some people, but not for others.

Takeaways

- As with Halo, Thync demonstrates the fact that consumer neurotechnology will have to deal with severe value proposition variability. The products will work for some people, but not for others. This comes down to differences in the nervous systems between individuals, so it’s going to be tough to mitigate.

- The value of this product is directly measured in emotional and subjective experience, in contrast to normal consumer electronics like cellphones, or even consumer neurotechnology like the Halo headphones whose value will probably fuse the quantitative (My maximum squat went up by 10%) with the qualitative (My workout felt great when I wore the headphones). The closest analogue is narcotics. On one hand, if affect-modulation technologies work, then they’re likely less risky than drugs since they don’t require inputting substances to the body. On the other hand, to the best of our knowledge, it’s unknown whether relaxation effects will attenuate over time. The attenuation could cause addiction behavior (more stimulus required for the same reward); but, if there isn’t attenuation, and the reward is consistent…would this prevent addictive behavior? These questions are worthwhile basic science questions.

- Should affect modulation companies have an obligation to investigate whether their products can become addictive? There’s probably no legal imperative, but there might be a PR imperative as the expectation of technology companies rightfully moves toward building products that are conscious of their emotional impact.

Use-Cases and Market Size

To build our model for the affect modulation market, we split the market into three subcategories: Positivity, Relaxation, and Energy. This could easily be extended to include other categories like Focus. We assume that devices will cost $200 (based on the original Thync), and most would employ subscription models for discardable physical components like adhesive pads and companion software—we estimate this as $15 / mo. Our model makes assumptions for market penetration split up by each of the three categories, and factors in churn.

Importantly, market penetration is relative to the “receptive subset” of the total addressable market. For example, if the total addressable market is every individual in the United States, only a subset of these individuals will be receptive to the idea of using neurostimulation to feel more positive or feel more relaxed. We guess these numbers right now, but we (or anyone else) could easily conduct a survey to replace our guesses with empirical point-estimates. Additionally, we make the limiting assumption that the receptive subsets of the TAM will be constant from 2018-2025 (the extent of our projections); this assumption is invalid because the receptive subset will probably grow over time as affect-modulation products become more popular. This growth rate could also be point-estimated empirically, although it would be more challenging. One additional assumption that could lead to an overestimate is that we consider Positivity, Relaxation, and Energy to require separate devices; it’s possible that, as with the original Thync, more than one of these effects will be achievable by a single device.

With the above considerations, noting conservative estimates for market penetration, we estimate that the U.S. market for affect-modulation technologies in 2025 will be $499,000,000.

Conclusion

In Part IV of our Consumer Neurotech series, we discussed consumer neurotech that directly modulates the human nervous system. In Part V, we’ll address some technologies that fall in a wildcard category.

- Volume I: Introduction

- Volume II: Neurotech for Control

- Volume III: Neurotech for Feedback

- Volume IV: Neurotech for Brain Modulation

- Volume V: Other Neurotech (The Odd Ones Out)

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.