As the biggest EV growth market over the next decade, China represents the single largest opportunity for EV makers. The country wants its automakers to expand outside of the region and sell globally. To do that, China needs Tesla. That’s of course good for Tesla, and we believe by 2025 China can account for 35% of Tesla auto deliveries, up from about 25% today. This implies Tesla will expand its China market share from about 15% today to between 20%-25% long term. The China opportunity is one of the reasons why Elon has said the company expects to grow global vehicle deliveries 40%-50% annually over the next decade.

An introduction to EVs in China

China has 18% of the world’s population and purchases 30% of all new vehicles. Within the new car sales market in the country, EVs are playing an outsized role compared to other countries. There are four points that define this gap.

- China is the world’s largest EV market, accounting for 50% of annual global EV sales in 2019.

- EVs total about 5% of annual new vehicle sales in China, compared to about 2% in the US.

- In 2020, we expect about 1m EVs will be sold in China, about 3x greater than in the US.

- Any automaker in China that produces locally is considered a local automaker and enjoys any incentives or government programs that China-owned car companies are entitled to. In other words, China views Tesla as a local automaker.

Made in China 2025

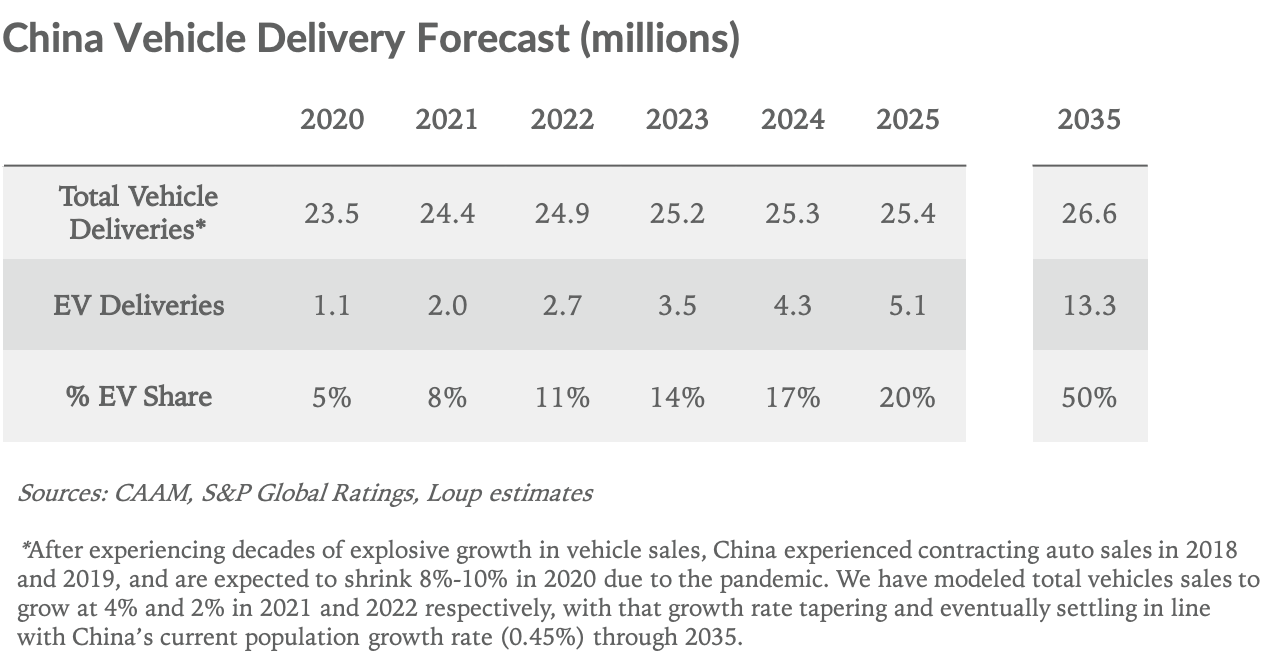

While EVs are a small percentage of cars sold in China today, the country’s goal as outlined in its “Made in China 2025” policy plan, is to have EVs account for 20% of all new vehicle sales in 2025, and 50% by 2035. Assuming China reaches its goal, that would imply more than 5m EVs sold in 2025 and over 13m in 2035.

The EV market in China

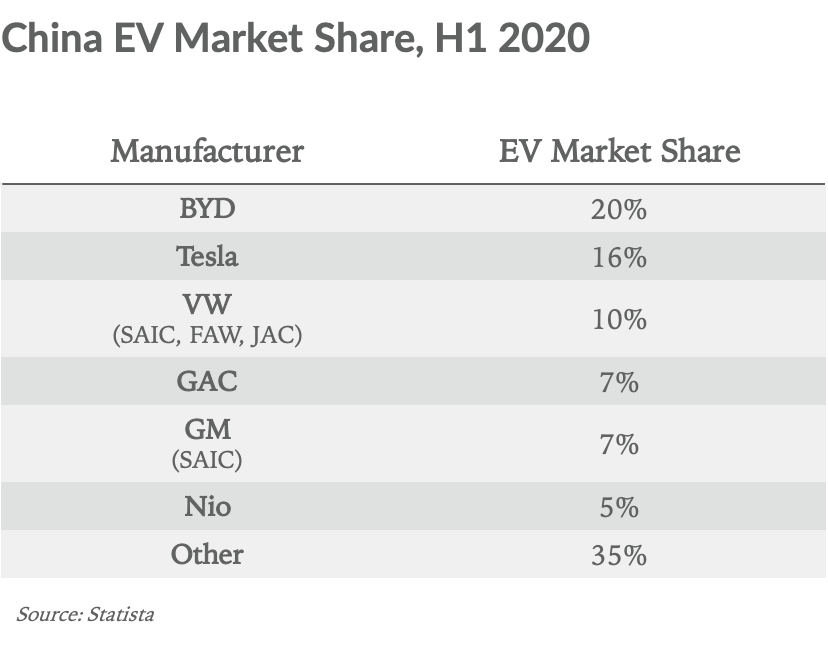

EV market share in China is split among several players, including domestic Chinese brands such as BYD and GAC, along with foreign brands partnering with Chinese companies, such as GM and VW. Tesla is a rare example of a wholly-owned foreign company with its own manufacturing presence in China.

Through the first half of 2020, 65% of China’s EV market was held by six OEMs, with the remaining 35% spread across several other manufacturers. It should be noted that because China’s EV market is still nascent, market shares can fluctuate significantly month-to-month. Domestic Chinese partners are shown in parentheses.

Ambitions beyond China

Today, outside of China, Chinese automakers have virtually no presence. Despite this fact, the country has ambitions beyond its borders to be the world leader in EVs over the coming decade. This implies that, eventually, Chinese automakers could account for more than 15% of total global (ex-China) car and truck sales, up from near zero today. In pursuit of these targets, the Chinese government has invested heavily in EV charging infrastructure and has given generous subsidies and tax credits to consumers and OEMs.

China Needs Tesla

In 2018, China lifted a requirement that foreign automakers partner with a domestic automaker, laying the groundwork for Tesla to begin construction on its Shanghai factory. This change is important because it allowed Tesla to build the first car factory in China with 100% foreign ownership, that is to say, with no financial ties to China. This begs the question: why did China change its long-standing partnership policy to motivate Tesla to build Giga Shanghai? The answer is that China’s EV industry needs Tesla to be a leader in EVs long term.

Taking a step back, the ship has sailed for a Chinese automaker to compete with gas-powered cars from the likes of VW, GM, and Toyota. That said, Chinese officials are well aware of two emerging factors. First, the auto industry will eventually go 100% electric, and second, the vast majority of established automakers outside of VW and GM are lagging when it comes to EV tech. Herein lies the entry point to boost China’s EV industry at the core: attract the global leader in EVs and let that company invest in China-made battery tech, support local parts makers, and most importantly, hire Chinese talent and let them learn from the best. Eventually, these employees will leave Tesla and start their own EV companies, join Chinese auto parts makers, or pair up with OEMs like BYD, GAC, and Nio. This is akin to how Silicon Valley started, with the roots of most tech companies tracing back to Fairchild Semiconductor, which was founded in 1957 and laid the groundwork for generations of tech innovation and startups in the region.

The Fairchild founders in 1961. Photo © Wayne Miller/Magnum Photos

Tesla’s path to increasing market share

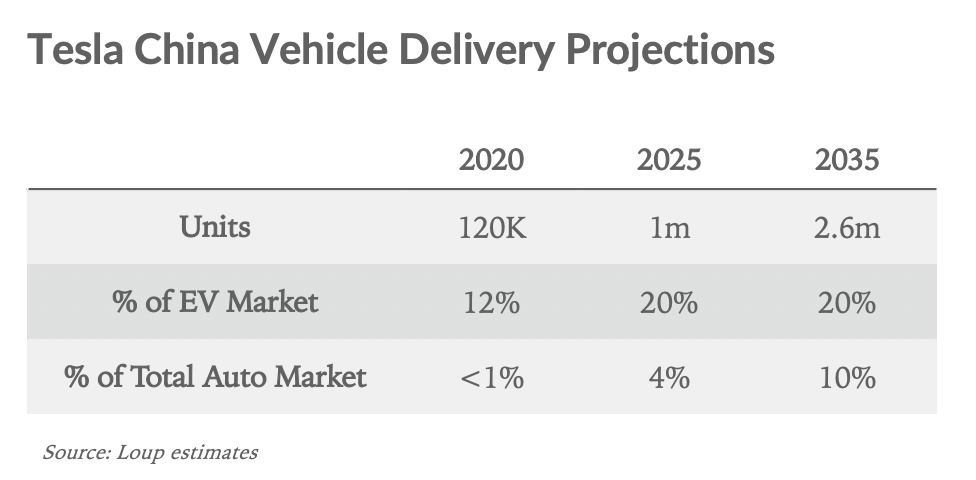

The company started delivering made-in-China Model 3s in December 2019. Through H1 2020, Tesla captured 16% of China’s EV market, declining to about 13% through October. At the end of October, vehicle deliveries in China stood at 95K which, as a point of reference, account for about a quarter of Tesla’s global deliveries.

Despite growing competition from Chinese startups such as Nio and Xpeng, we believe Tesla can grow its China EV market share over the next decade-plus to 20-25%. This will be aided by the arrival of the Model Y and Model 2.

- Model Y availability in China should ramp in 2021, which will give the company a compelling offering in the SUV/Crossover segment. While SUVs/Crossovers account for only ~10% of EV sales to date, they account for more than 40% of all vehicle sales in China. We see this dynamic as a result of a lack of compelling EV offerings in the SUV/Crossover vertical, given larger vehicles require bigger batteries that make the category prohibitively expensive. Long-term, this dynamic will be solved, and we expect SUVs/Crossovers to account for a similar 40% plus of EV sales.

- Model 2 has yet to be announced and is likely to see production begin sometime in 2023. Elon hinted at the new model in September with an expected starting price of $25,000, compared to the Model 3 around $37,000. We believe the car will be produced at both the Shanghai and Berlin gigafactories. This smaller, lower-priced model should do well in China.

Assuming China achieves its EV delivery targets of 5m in 2025 and 13m in 2035, 20% EV market share for Tesla would imply 1m vehicle deliveries in 2025 (up from what will be about 120K for the full year 2020) and 2.6m in 2035. From a production standpoint, for Tesla to achieve these delivery numbers the company will either need to add another China Gigafactory, or import vehicles into the region.

Will Chinese consumers continue to pay up for a Tesla?

We looked at sale prices for the top 15 selling EVs in China (excluding the Tesla Model 3 and Nio ES6 which were the two highest priced models) and found an ASP of about $20,000. The lowest-end models ran roughly $12,000. This is of course lower than the Model 3, which sells for about $37,000 in China.

We recognize that in the years to come there will continue to be new, lower-priced EVs released in the region. Some can even be priced sub-$5,000. At first take, this would suggest Tesla is too expensive for the market. However, the fact that Tesla has enjoyed success in China despite being priced 2x-3x more than the competition is a positive sign the company will continue its success moving forward. We believe the Chinese consumers looking to spend less than $10,000 would not have considered purchasing a Tesla in the first place. Long-term, Model 2 should be more competitive with these lower-priced options.