Bioelectronic medicine is like a medical supplies aircraft flying close to the surface of the sea: significant promise, and under the radar.

As a field, bioelectronic medicine (BEM) is a paradigm shift from existing medicine: instead of treating patients by intervening with the bloodstream, patients are treated by intervening with the nervous system. At Loup Ventures, we think the time is ripe and the opportunity large to learn about BEM because it can provide novel therapeutic value, yet according to our research takes 1/3 of the time and 1/10th of the cost to develop as traditional pharmaceutical-based treatments.

The Doctrine of Bioelectronic Medicine

Bioelectronic medicine can be explained most simply by what we might call the “Doctrine of Bioelectronic Medicine.” Our inspiration for the DBM was the explanation offered by Dr. Manfred Franke in his interview with Ladan Jiracek on the Neural Implant Podcast, and the term “Doctrine of Bioelectronic Medicine” itself is something we created at Loup, a tongue-in-cheek reference to the Neuron Doctrine.

Think of your body as a superbly complex system. As a person, or a scientist, or an engineer, or a business operator, or a biotechnology/medical technology investor, you want to know things about this system. What information is in it? What information can we put into it in order to make this system behave how we want it to?

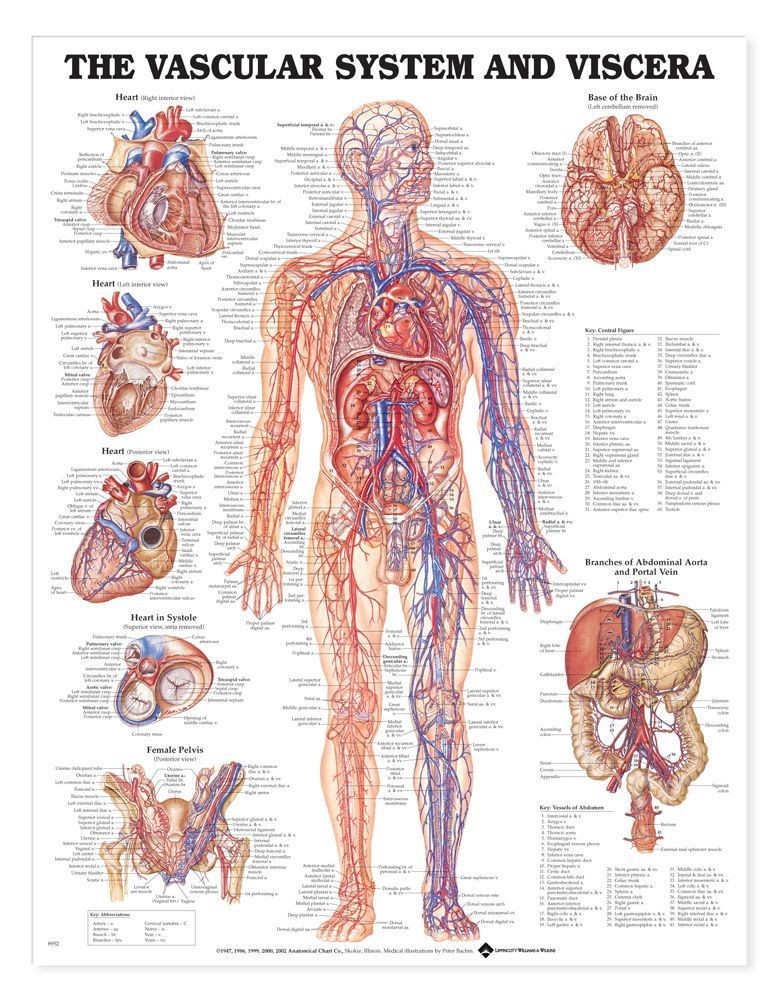

The way this works right now is that we use the bloodstream information pathway. In other words, we think about chemicals traveling through the bloodstream: what kinds of proteins do we see in cell membranes? What kinds of cells? Which genes are expressed? Which molecules can we put into the bloodstream in order to have the desired effect?

But, the trouble with intervening with the human body via the bloodstream is that humans (and other species) have evolved to respond to changes in the chemical composition of the bloodstream. Any time we try to intervene, we have unintended side-effects, and getting desired information out of the bloodstream is difficult to do in real-time because we need to record at the molecular scale.

So, as Dr. Franke explains, we could look at the second information pathway: the nervous system information pathway. The activity of organs in the body is, at least partially, orchestrated by the brain and spinal cord, so the nerves in your body contain some kind of signal coming from the brain/spinal cord to control those organs. Likewise, the brain listens to those organs in order to determine how to modulate their function in pursuit of homeostasis, or to change their function for temporary allostasis (i.e., causing temporary change in order to eventually achieve homeostasis). Another term for this nervous system information pathway is a reflex arc (“reflex” because you don’t have conscious control over it, and “arc” because it’s a loop).

The major insight of bioelectronic medicine is that listening to information in the nervous system is easier than listening to information in the bloodstream, and putting information into the nervous system is easier than putting information into the bloodstream.

Interacting with the nervous system entails instantaneous therapeutic effects instead of the minutes-to-weeks for drugs. Additionally, this minimizes side-effects because the neural stimulation is very precise as compared to circulating a molecule through the bloodstream. It’s easy to envision avoiding the difficult medication interactions faced by patients with various conditions.

Nervous system anatomy and physiology

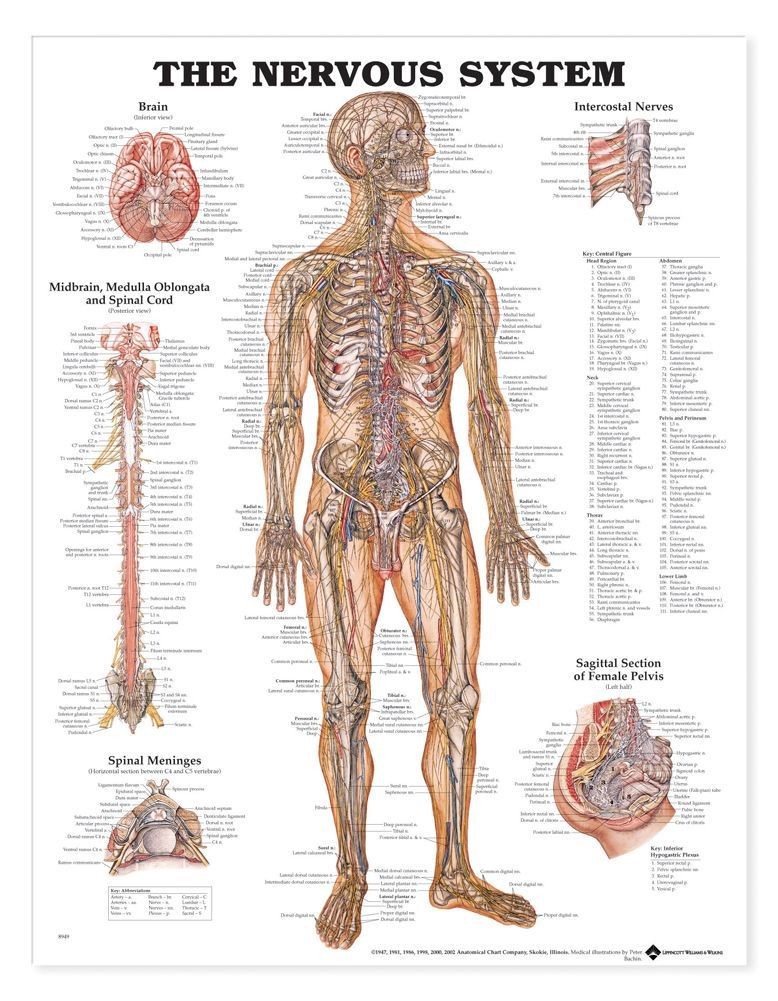

Here, we’re going to dive into a quick overview of the nervous system because it’s important context to have for understanding BEM. The nervous system is a network of cells that all share similar properties: they have a cell body called a soma, branches called dendrites that usually receive information from other neurons, and long branches called axons which usually carry information to other neurons. These cells exist throughout the entire body, including, of course, the brain.

The major division in the nervous system is between the central nervous system, which includes the brain and spinal cord, and the peripheral nervous system, which includes all other neural tissue.

Central nervous system: brain and spinal cord

With any luck, everyone reading this is familiar with the brain as an entity. Neuroanatomy is complex and occasionally fuzzy, so here are the basic important parts. The cortex is the outer layer of the brain, and it’s the phylogenetically most recent (i.e., it’s the most recent part of the brain to be evolved). The cortex is considered to be part of a division of the brain called the forebrain, or the prosencephalon — forebrain and prosencephalon are equivalent terms. Higher-order cognitive processes are thought to occur primarily in regions of the cortex as opposed to other regions of the brain; examples include executive processing and decision-making, planning and executing body movements, and visual processing. Most brain-focused interfaces, such as EEG or multi-electrode arrays (see below), record from or stimulate neurons in the cortex.

Image: edoctoronline.com—here, we see the distinction between the Forebrain, Midbrain, and Hindbrain as demonstrated in the adult human brain.

Image: edoctoronline.com—here, we see the distinction between the Forebrain, Midbrain, and Hindbrain as demonstrated in the adult human brain.

For the sake of analogy, if the brain is roughly earth-shaped, then the cortex is the crust (the Latin word cortex means “bark of the tree”). Naturally, there are subcortical structures — i.e., everything else that’s beneath the earth’s crust (cortex). The subcortical structures have intricate classifications which aren’t worth detailing right now, but the short version is that they’re involved in many, if not most, things that we don’t have conscious awareness of (and plenty that we do). In other words, the cortex is strongly implicated in conscious awareness, and the subcortical structures do the tons of other things our brains do which we don’t classify as part of the human conscious experience.

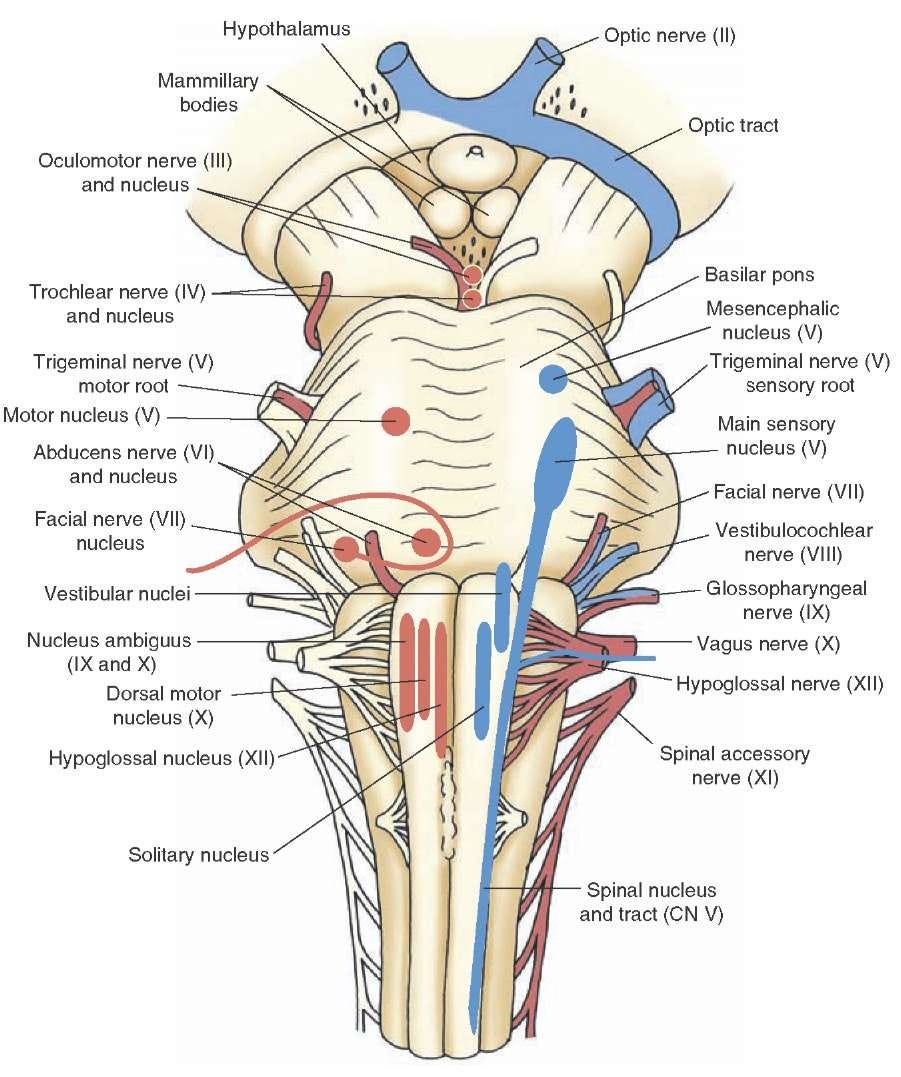

Image: what-when-how.com—brainstem and cranial nerves.

Image: what-when-how.com—brainstem and cranial nerves.

Beneath the main sort-of-spherical body of the brain sits the brainstem. The intuition behind the brainstem is that it controls what comes into and out of the brain, making it of particular importance to BEM. Some important anatomical features of the brainstem are ten of the 12 cranial nerves (the other two don’t originate in the brainstem). These nerves either carry information from the brainstem to the body, or from the body to the brainstem, or both. We mention the cranial nerves because they are prime targets for implantable bioelectronic medicine devices. In particular, CN X, the vagus nerve, holds much promise in large part due to the fact that it originates from the brainstem, then branches all over the body.

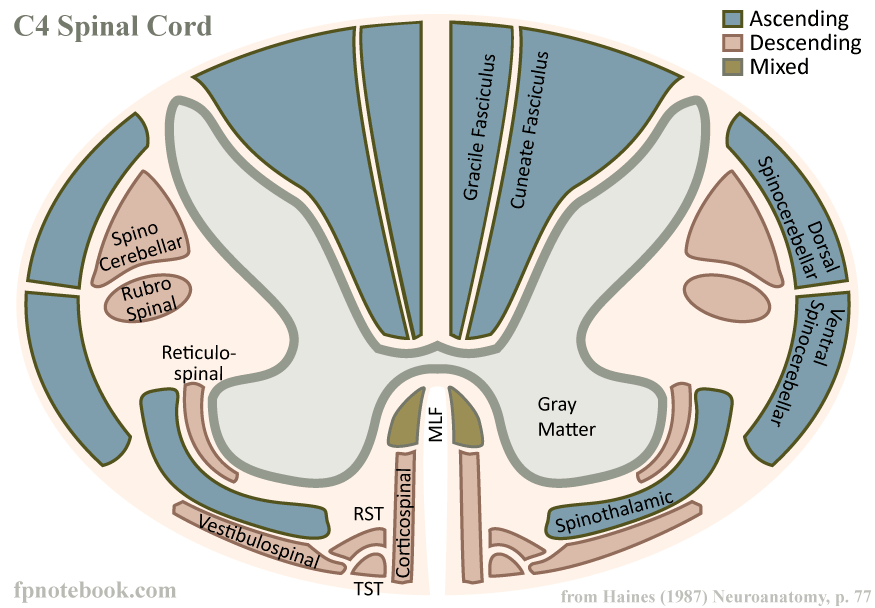

Image: fpnotebook.com—diagrammatic cross-section of the C4 level of the human spinal cord.

Image: fpnotebook.com—diagrammatic cross-section of the C4 level of the human spinal cord.

A large number of axons project downwards from the brainstem, and these bundles of axons (in addition to some other neurons) become the spinal cord. The spinal cord does three things:

- It carries information coming down from the brainstem to control your muscular system and some of your internal organs. These are known as motor pathways.

- It carries information back to the brain from your somatic sensory systems (somatic = body…i.e., skin, muscles, bone) and visceral sensory systems (viscera = within the body…i.e., organs).

- The spinal cord performs computations to help with things like walking so that your brain doesn’t have to do the heavy detail work itself. Neurons in/near the spinal cord send their axons into the rest of the body, at which point they’re referred to as the…

Peripheral nervous system

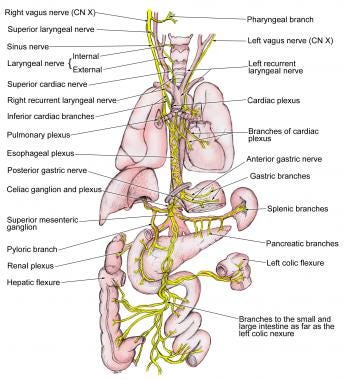

The peripheral nervous system encapsulates all other nervous tissue in your body that isn’t part of the spinal cord, brainstem, or brain. Branching off from the spinal cord and brainstem are many nerves which control muscles, tendons, respiration, digestion, urination, liver function, and more.

Image: emedicine.medscape.com

Information in the nervous system

The neuron doctrine posits that neurons, via electrochemical signaling, are the primary conveyors of information within the nervous system. In other words, the nervous system exerts control over the body by sending electrochemical signals between neurons. This doctrine has been the basis for most of the existing neuroscience research.

A gross oversimplification is that a “signal” in the nervous system is represented by one neuron “firing” and therefore making other neurons more likely to fire through various biochemical mechanisms. To “fire” means that there is a temporary change in the electrical properties of a neuron: relative to the surrounding water-filled environment, the inside of a neuron becomes more positively charged (i.e., the voltage across the cell membrane becomes more positive). This causes changes to occur in the neuron, which in turn causes neurotransmitters to be released onto the dendrites (or sometimes somas or axons) of other connected neurons, making it more or less likely for those connected neurons to “fire.” This “firing” phenomenon is called an action potential.

When we record electrical signals from the nervous system, what we’re really trying to do is to figure out which neurons or populations of neurons have action potentials, and when.

So, to reiterate: the information in the nervous system is probably represented by the brief changes in the electrical properties of a cell. If we want to listen to that information, then we need to know which cells have changes in their electrical properties at a given point in time. If we want to put information into the nervous system, then we want to cause the electrical properties of neurons to change at certain times.

Bioelectronic medicine desires to do both, so let’s learn how!

Recording from and stimulating the nervous system

We now know how the nervous system sends information around the body, so our task is thus to record from and stimulate it.

What do we want in a recording/stimulation system?

Depending on whether we’re working with the brain, the spinal cord, or the peripheral nervous system, different techniques apply. Before looking at individual techniques, though, it’s useful to think about a framework for assessing how good or not good they are. Some common ways to analyze a neural interface:

- Spatial resolution: how small are the details we can discern? Can we tell when an individual neuron fires? Or just when a large group of neurons is active?

- Temporal resolution: what is the shortest length of time during which we can detect a change in the nervous system?

- Invasiveness: do we need to perform surgery to implant a device in order to record from/stimulate the nervous system?

- Device ergonomics: how big is the device? Can it be powered wirelessly? If externally visible, is it visually appealing? Is it easy for a prospective patient to use?

- Biocompatibility: if the neural interface has been implanted, to what extent does the body try to reject it? To what extent does this rejection process damage the neural interface and reduce its recording quality?

Types of recording/stimulating technology (warning: not even close to exhaustive!)

Image: Nicolelis and Lebedev, 2017

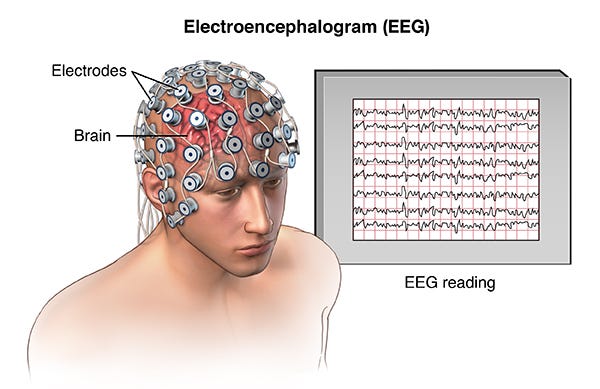

Electroencephalography (EEG)—recording

- Spatial resolution: low (cm scale)

- Temporal resolution: high (ms scale)

- Biocompatibility: very high (noninvasive)

- Uses: real-time brain recordings; characterizing cognitive or affective states

- Pros: great temporal resolution, relatively cheap

- Cons: very finicky, lots of noise in the signal due to the thickness of the skull and other biological events that cause electrical signals, like blinking or clenching your jaw

Image: https://hvmn.com/biohacker-guide/cognition/eeg-measures-of-cognition

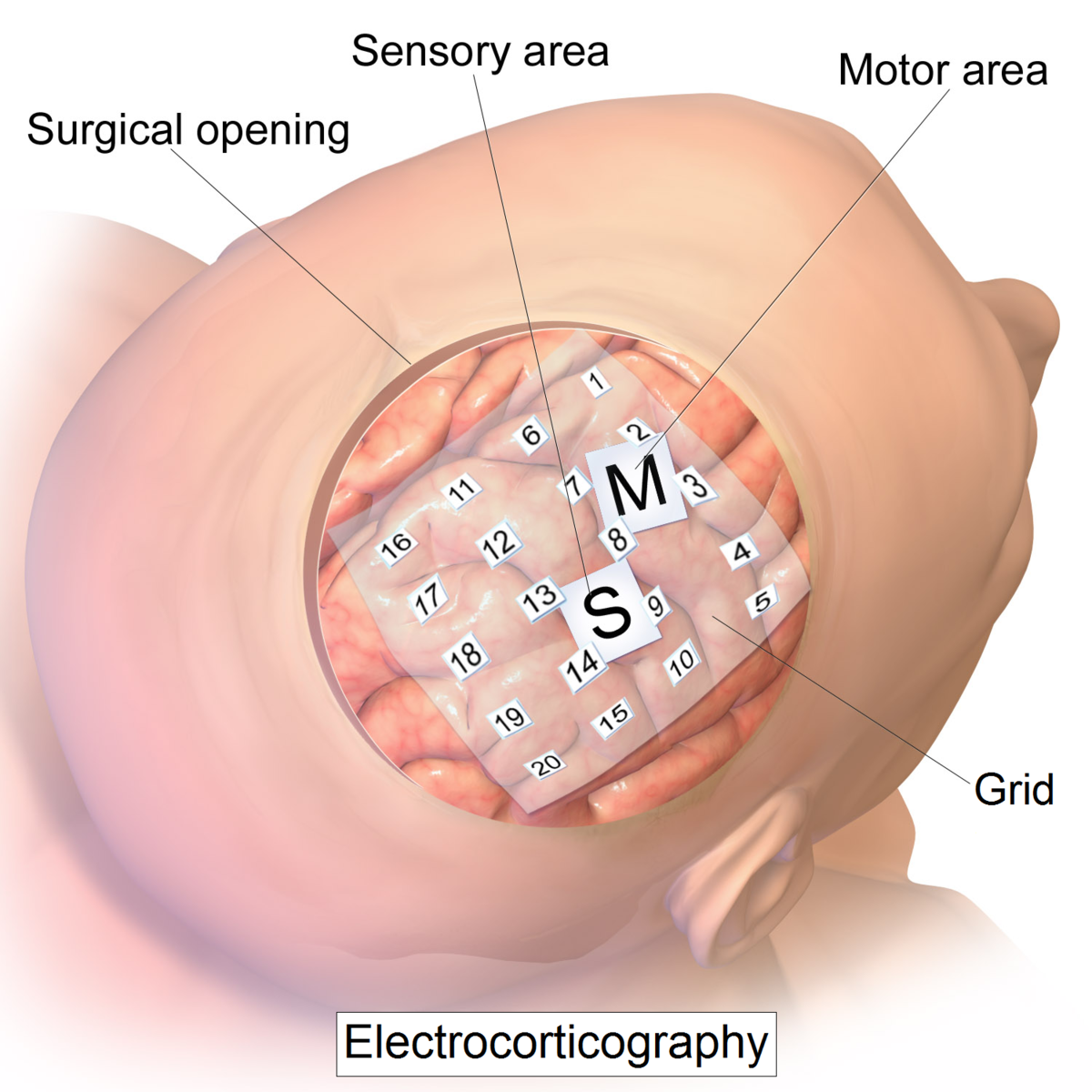

Surface electrode array: electrocorticography (ECoG)—recording

- Spatial resolution: low (cm scale)

- Temporal resolution: high (ms scale)

- Biocompatibility: high (this technology sits below the skull, but doesn’t penetrate the cortex, therefore minimizing inflammatory response)

- Uses: real-time brain recordings, brain mapping (e.g. before a brain surgery)

- Pros: great temporal resolution; sits on the surface of the cortex so it doesn’t penetrate neural tissue and therefore has good biocompatibility

- Cons: records populations of neurons rather than individual neurons; requires a craniotomy to implant (i.e., the skull has to be opened)

- Notes: variants on this technology called cuff electrodes are frequently used in the peripheral nervous system to record from peripheral nerves. These interfaces are like a small version of ECoG arrays which get wrapped around nerves (hence, “cuff”).

Image: https://en.wikipedia.org/wiki/Electrocorticography

Image: https://en.wikipedia.org/wiki/Electrocorticography

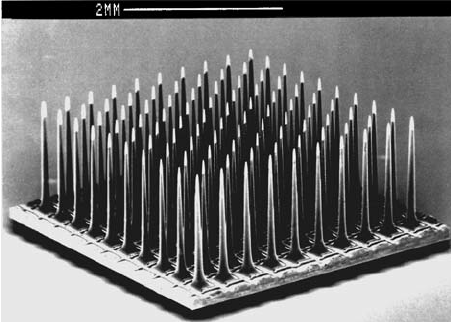

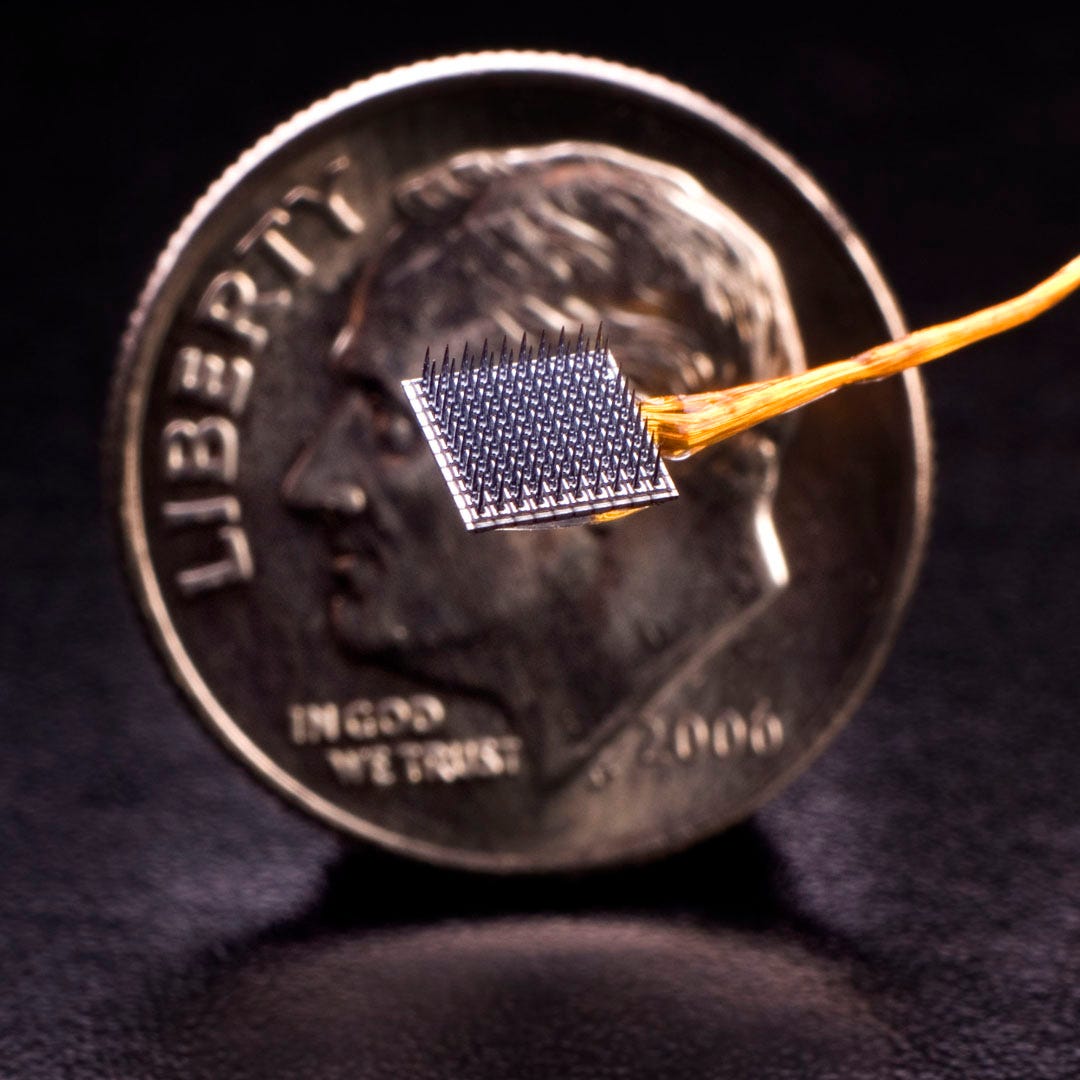

Intracortical multi-electrode array (MEA)—recording and stimulation

- Spatial resolution: high (µm scale)

- Temporal resolution: high (ms scale)

- Biocompatibility: low (this technology directly penetrates the cortex)

- Uses: high-grade brain-machine interfaces; long-term implantation; eventually, restoration of movement to paralysis patients and other such therapeutic applications

- Pros: depending on the details of the electrode array and the body’s immune response, can get data about single neuron activity

- Cons: low biocompatibility; requires invasive surgery; the signal quality degrades over time; only records from a small region of the cortex, since the array itself has to be very small

Image: ResearchGate

Image: ResearchGate

Functional magnetic resonance imaging—recording

- Spatial resolution: fairly high (mm scale)

- Temporal resolution: low (seconds scale, with a 2–5 second delay between neural activity and recorded response)

- Biocompatibility: not applicable; MRI scanners are large external machines

- Uses: used for whole-brain imaging; this technology uses magnetic resonance imaging to detect how much oxygen is in the brain’s blood, which is thought to represent underlying neural activity

- Pros: spatially precise whole-brain imaging

- Cons: huge and expensive machine; can’t be used for an everyday brain-machine interface; its applications are limited to research and diagnostics; low temporal resolution; indirect recording of neural activity

Image: USC

Image: USC

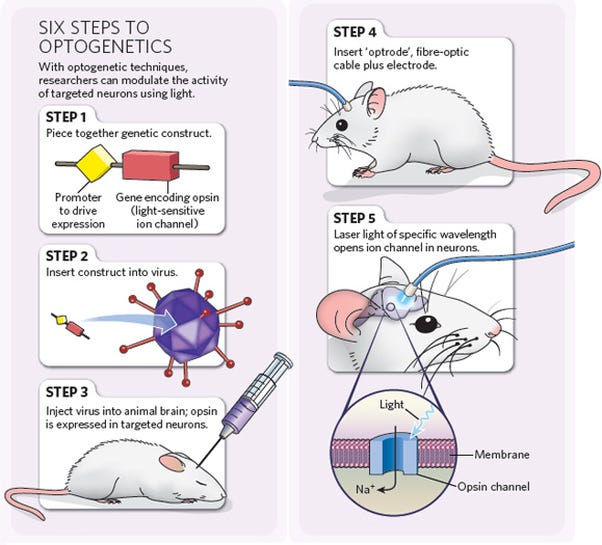

Optogenetics—stimulation

- Spatial resolution: extremely high (µm scale)

- Temporal resolution: extremely high (ms scale)

- Biocompatibility: complex; optogenetics requires the genetic modification of cells you wish to stimulate, and requires the implantation of an LED or other light source within the desired neural tissue

- Uses: researching neural circuits; experimental retinal prostheses; cells are genetically modified to produce light-responsive proteins in the cell membrane which, when bombarded with light of a certain wavelength, can increase or suppress the firing of a neuron

- Pros: Highly precise; can be used to stimulate small groups of neurons and therefore establish causality in neural circuitry

- Cons: requires genetic modification of cells; requires the implantation of a device to provide light; can’t yet be used in humans

Image: http://optogenetics.weebly.com/why–how.html

Image: http://optogenetics.weebly.com/why–how.html

Frontiers in recording from/stimulating the nervous system

Power source: Before neural interfaces can be used at scale in patient populations — whether for the central nervous system or the peripheral nervous system — the devices need to be made more ergonomic. It’s highly undesirable to have a cable running out from the skull or the skin, as in the case of the commonly-used Utah Array, and therefore devices need to be powered wirelessly (or through other means).

Image: kavlifoundation.org; Utah Array with a wire bundle

Image: kavlifoundation.org; Utah Array with a wire bundle

Biocompatibility/longevity: The body tends not to respond well to foreign substances, and this is manifested through an inflammatory response. Inflammatory responses are neither healthy for the patient nor good for the longevity of the implanted device.

Spatiotemporal resolution: Any attempt to record from the nervous system needs to digitize neural signals that have the highest spatial and temporal resolutions as possible; in order to understand the nervous system, we need data that accurately describes its function. Better data will open up many new possibilities/use-cases for brain-machine interfaces and bioelectronic medicine.

Miniaturization: In order to get better conjoint spatial/temporal resolution spread out over large regions of the brain, we currently have to use very cumbersome and clinically impractical devices (such as magnetoencephalography or functional MRI). In order for such whole-brain recording techniques to truly add therapeutic value, these (or similar) technologies must be miniaturized.

Minimizing invasiveness: The ultimate goal of bioelectronic medicine and brain-machine interfaces is to provide long-lasting therapeutic value to patients. Even assuming all other factors have reached satisfactory levels of patient-friendliness and usefulness, the fact of the matter is that these technologies still need to be surgically implanted. Deciding to get surgery will be a large barrier to delivering patient therapy, and likewise for achieving profitability in BEM/BMI ventures. Therefore, the more minimally invasive a BEM/BMI modality is, the better off both patient and product developer.

Business models and regulation

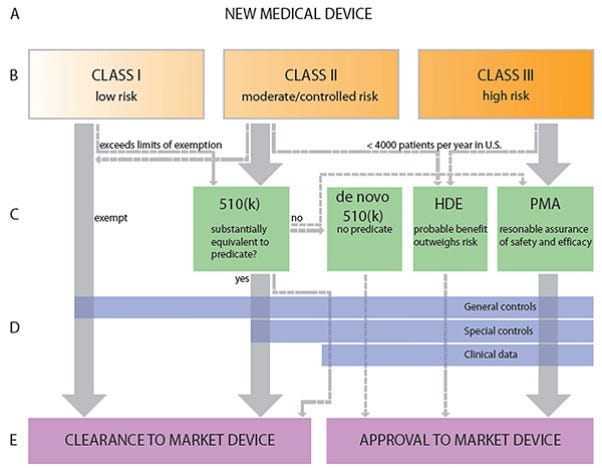

Bioelectronic medicine devices fall within the category of medical devices. For the development of medical devices, business models and regulation by the FDA are tied closely together — this is particularly true for new/startup companies, where funding is devoted explicitly to product development and clinical trials, and for whom a business model can’t be fully validated until devices have been approved by the FDA and can be sold on the market. Hence, in order to understand the BEM opportunity, we’ll discuss business models and regulations around medical devices.

Regulation

In the United States, the Food and Drug Administration (FDA) has been tasked by Congress with regulating medical device development and marketing. The FDA, in general, has two goals:

- Protecting the public from unnecessary illness or injury by subjecting medical devices to a regulatory scheme designed to ensure that the devices are safe and effective.

- Encouraging the development and marketing of medical devices by crafting a nationally uniform regulatory scheme that prevents overregulation and thus ensures that development can be economically feasible.

In other words, the FDA needs to promote the creation of helpful medical devices in a timely manner, but also make sure those devices are safe and working well.

Image: Clemson University Libraries

Image: Clemson University Libraries

The FDA specifies three device classes: Class I, Class II, and Class III. Class I are low-risk devices such as elastic bandages; they must be registered with the FDA, but don’t need to undergo premarket review. Class II are intermediate-risk devices like a powered wheelchair or a syringe; they require a 510(k) premarket notification, in which the manufacturer must notify the FDA of their intent to market the product. The company must prove to the FDA that their product is substantially equivalent to a previously-existing product on the market. It costs roughly ~$24M to get a medical device through the 510(k) approval process, and takes on average 31 months. Class III devices are high-risk devices such as an implantable electrode array, and they require a premarket approval (PMA), in which the manufacturer must rigorously prove safety and efficacy of the product. A PMA costs ~$100M for a medical device, and on average takes 54 months. In order to begin collecting the necessary data from a device to file for a 510(k) or a PMA, the manufacturer needs to obtain an Investigational Device Exemption (IDE). For 510(k) and PMA devices respectively, it costs $400,000 and $750,000 per month spent pursuing an IDE. Upon obtaining the IDE, it costs roughly $520,000 or $740,000 per month to wade through the 510(k) and PMA processes, respectively. It’s worth noting that almost all BEM/BMI devices will be Class III.

It’s widely thought that there are various problems with the current FDA medical device regulatory process. In general, device approval takes far longer and is much more expensive and time-consuming than in Europe, likely with little benefit to patients; according to one article, products become available to US patients two years after they become available in Europe, yet there’s no evidence that device safety in the US is improved over device safety in Europe, thus highlighting unnecessary risk-aversion in the FDA regulatory process. One additional problem domain is that of “substantial equivalence” required for 510(k) approvals: this process has been letting potentially unsafe devices onto the market since substantial equivalence can be proven with respect to devices that are decades old and no longer the medical standard-of-care.

Business model

The medical device market, of which BEM is a component, operates in counterintuitive ways. Generally speaking, hospitals are the purchasers of medical devices and select them based on decisions made by doctors and physicians. Physicians, the providers, are then responsible for prescribing or implanting the medical devices in patients. Patients work with insurance companies, the payers, on how to cover costs with the devices they use for treatment.

This relational web is often viewed as having misaligned incentives for several reasons. At a high level, medical device companies often market their products directly to providers (physicians) through a number of channels. As such, a major goal of device manufacturers is to establish relationships with said providers—however, providers are oftentimes unaware of the true costs to the patients and also to the hospitals (purchasers) of said devices. Hospitals face pressure from insurance companies (payers) and patients to keep costs low to try and mitigate the overall out-of-pocket costs for both parties. However, hospitals also rely on physicians to bring in revenue and therefore are forced to balance on a thin line between keeping physicians happy by not constraining their selection of medical devices and keeping patients and payers happy by keeping costs as low as possible when purchasing devices. One way hospitals manage this is by entering into hospital Group Purchasing Organizations (GPOs), which act as a “union” of sorts to manage hospital costs across large networks of providers. Healthcare companies must navigate this incentive lattice in order to effectively market their products to purchasers.

Addressable market

- Spinal Cord Injury – 280,000 patients in the US as of 2016, with a $2.3B global market as of 2017.

- Alzheimer’s Disease – 5.7M patients in the US, with a $1.7B market in North America as of 2017.

- Amyotrophic Lateral Sclerosis – 30K patients in the US, $16M market in the US as of 2018.

- Stroke – 795,000 strokes per year in the US (144,000 deaths per year caused by strokes); $6.5B market in the US as of 2016.

- Rheumatoid Arthritis – 1.5M patients in the US; $11.5B market in the US as of 2016.

- Mental Health/Substance Abuse – 43.8M adults in the US experience mental illness annually; based on data through 2013, the US mental health and substance abuse services industry was expected to produce $53.2B in revenues in 2017.

General comments

- The highest market share for bioelectronic medicine devices is currently from the arrhythmia market; specifically, from implantable cardioverter defibrillators and from cardiac pacemakers.

- Areas which are expected to grow significantly in the near future are spinal cord stimulation, deep brain stimulation, and sacral nerve stimulation. Spinal cord stimulation has the opportunity to address chronic pain, failed back syndrome, and ischemia. Deep brain stimulation is targeted at Parkinson’s and major depression. Sacral nerve stimulation can, among other things, be utilized for overactive bladder syndrome via Medtronic’s minimally invasive neuromodulation system.

- North America accounted for the highest market share of revenue for electroceuticals (another term for bioelectronic medicine products, emphasizing that the products can be prescribed like pharmaceuticals) in 2016; Asia-Pacific markets are expected to experience the highest growth in coming years due to their changing healthcare landscape and aging geriatric populations.

- Increasingly, bioelectronic medicine development is being funded by governmental organizations, as well as by large and leading industry players like GSK, Boston Scientific, and Google.

- As would make sense, hospitals are expected to be the largest consumer of electroceuticals due to the prevalence of chronic diseases such as arrhythmias, epilepsy, Alzheimer’s, retinitis pigmentosa (loss of photoreceptors in the retina), chronic pain, and depression. In other words, since bioelectronic medicine devices are medical devices, the purchasers will be hospitals (not general consumers). This is an obvious fact, but worth restating since this piece assumes no knowledge of medical devices.

- Medical device companies are difficult to run: 80% of medical device companies have <100 employees and suffer cash flow risk due to regulatory inefficiencies.

- Many of the bioelectronic medicine companies are pharmaceutical companies, medical device manufacturers, or other healthcare-related companies who are beginning to foray into the territory of BEM. Amongst the largest of these entrants include: Galvani (co-owned by Verily, a Google life-sciences subsidiary, and GlaxoSmithKline, a British pharmaceutical company), Boston Scientific, Medtronic, Cochlear, Ltd., Nevro Corp, Johnson & Johnson, Biotronik, and electroCore.

- To give a sense of the investment landscape around BEM, we’ll discuss the VC funding landscape for healthcare. Per PWC research, in 2017 total healthcare funding hit a record high of $14.4B across 748 deals; total funding had a year-over-year increase of 25% while total deal volume increased around 15% year-over-year. From 2012 to 2017, average deal size has increased from $10M to $19.3M. Of particular relevance to bioelectronic medicine, the medical device sector received $1.37B of investment in 2017, accounting for 9.5% of the total healthcare industry funding (72 deals with an average deal size of $20.2M). According to Mercer Capital’s research, total VC exit value was approximately $51B spread over 769 exits, the lowest number of exits since 2011. In 2017 there were 27 medical device IPO filings with an aggregate $2.2B estimated proceeds. Total aggregate proceeds and IPO volume for medical device companies has been steadily declining since it’s peak in 2014.

In Conclusion

Loup Ventures is excited by the emerging BEM market because, as compared to pharmaceuticals, BEM devices cost 1/10 as much and take 1/3 as long to develop, and they can deliver treatments that leverage reflex arcs and other nervous system-body pathways with fewer side effects than drugs. Over the next few years, more and more innovations will a) spill out of academia into industry, and b) be funded and/or pursued by existing large industry players. As such, we think the time is ripe to grow conversation around technologies that interface with the nervous system so that we can create widespread understanding of funding models, areas of opportunity, and ethical considerations. In other words, our aim is to fly the bioelectronic medicine airplane a little higher, putting it on investors’, academics’, analysts’, and the public’s radar.

Note: this article is not intended to be an authoritative piece of science literature; some information about these topics has been omitted or simplified.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.