Apple will report Mar-19 earnings after market close on Tuesday, April 30th. We continue to believe that Apple will be the best performing FAANG stock in 2019. Here are our thoughts going into Tuesday.

Bottom line: Strength of Services is leading the business until the 5G iPhone cycle. Anticipation will start to build in late 2019 and we expect a 5G product in late 2020. Investors are slowly shifting their focus away from the iPhone cycle and valuing the company more based on the ecosystem of hardware, software, and services, but it will take several years for this to become consensus.

- Mar-19 will be representative of the balance of 2019 – a business in a predictable 4% revenue decline (with iPhone revenue down about 16%, and Services up 15% plus).

- For Mar-19, we expect revenue and earnings slightly better than consensus of $57.6B and EPS of $2.37, implying a 5% revenue decline, a similar decline to Dec-18.

- The high end of the June revenue guidance should be in line with the Street’s $52.1B estimate. Apple typically comes in at the high end of its guidance range.

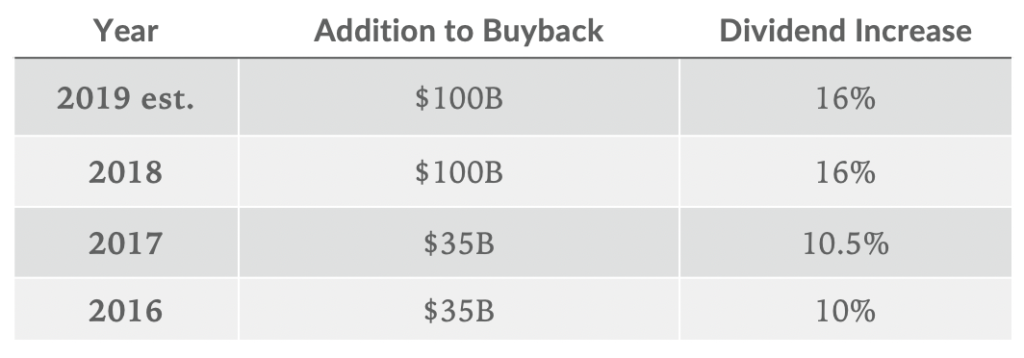

- We expect Apple will add $100B to the buyback and increase the dividend by 16%. This is in line with last year’s changes to the program.

Strength of Services is Leading until the 5G iPhone Cycle

- Investors have written off the iPhone this year, comfortable with what will be about a 16% decline in sales because Services (18% of revenue) will bridge the gap to the next iPhone cycle.

- The hurdle for the stock in 2019 – Apple needs to exceed the Street’s 15% Services growth estimates by several points, given some upside to Services has recently been priced into shares.

- Apple’s other hardware businesses are doing well, with FY19 Mac and iPad likely to grow revenue in the 4-8% range, and wearables at 25%.

Best Play on 5G

- Over the next few years, Apple stands to be one of the biggest beneficiaries of 5G which should provide upside to the Street’s current FY21 estimate of 2% iPhone growth.

- Importantly, anticipation of 5G should start to expand AAPL’s multiple this fall.

- The company’s initiatives in AR, wearables, healthcare, and transportation will also benefit from 5G.

- Healthcare and transportation are the two largest untapped tech TAMs, with $7 trillion and $10 trillion global annual spends respectively.

Capital Return Program Update

- We expect Apple will add $100B to the buyback and increase the dividend by 16%. This is in line with last year’s changes to the program.

- Below are the changes to the program over the past 3 years.

Net Cash Neutral Lever

- Tim Cook said on the Mar-18 earnings call that Apple will be net cash neutral “over time,” but stopped short of specifying a timeline. Since then, details have been limited. We believe the timing of reaching net cash neutral will be a central topic on the earnings call.

- Getting to net cash neutral is one of Apple’s biggest levers to move shares higher. We expect Apple to be net cash neutral in 3 years, ahead of investor expectations of 5 plus years.

- To become net cash neutral, Apple will have to reduce its cash balance by $130B. We expect Apple to return $300B to investors in 3 years (cash from operations + cash draw down from balance sheet), with ~85% through buybacks.

- The mechanics are simple. Buybacks lower share count and raise EPS, which should theoretically move shares of AAPL higher by 24% over the next 3 years.

On Apple’s Multiple

The Street’s obsession over iPhone units has distracted investors from the fundamentals and weighed heavily on Apple’s multiple.

The company’s recent decision to end the reporting of hardware unit numbers should help focus investors on what matters most: revenue and earnings growth.

Apple is increasingly performing like a services business, so we thought it appropriate to compare Apple’s current multiple to a few SaaS multiples including Salesforce and Adobe. Adobe currently trades at 29x forward earnings, and Salesforce trades at 48x. Apple trades at 16x next year’s earnings.

We also looked at consumer staples companies, given they, like Apple, tend to be longer-term, lower growth, and higher visibility. Clorox, for example, currently trades at 23x forward earnings and Coca-Cola trades at 21x. While we do not believe these are the appropriate comp groups for Apple, the valuation differences illustrate how little respect Apple’s multiple receives. These examples are extreme but serve to demonstrate why Apple as a Service is not being properly valued.

Apple has dependable, long-term customers. Stable businesses like Clorox and Coca-Cola earn their multiples because the underlying investment is less risky. The 2019 iPhone decline sets back the view that Apple’s business is as dependable as Clorox. That said, we expect iPhone to return to stability, and Services to slowly win investor confidence and a higher earnings multiple.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.