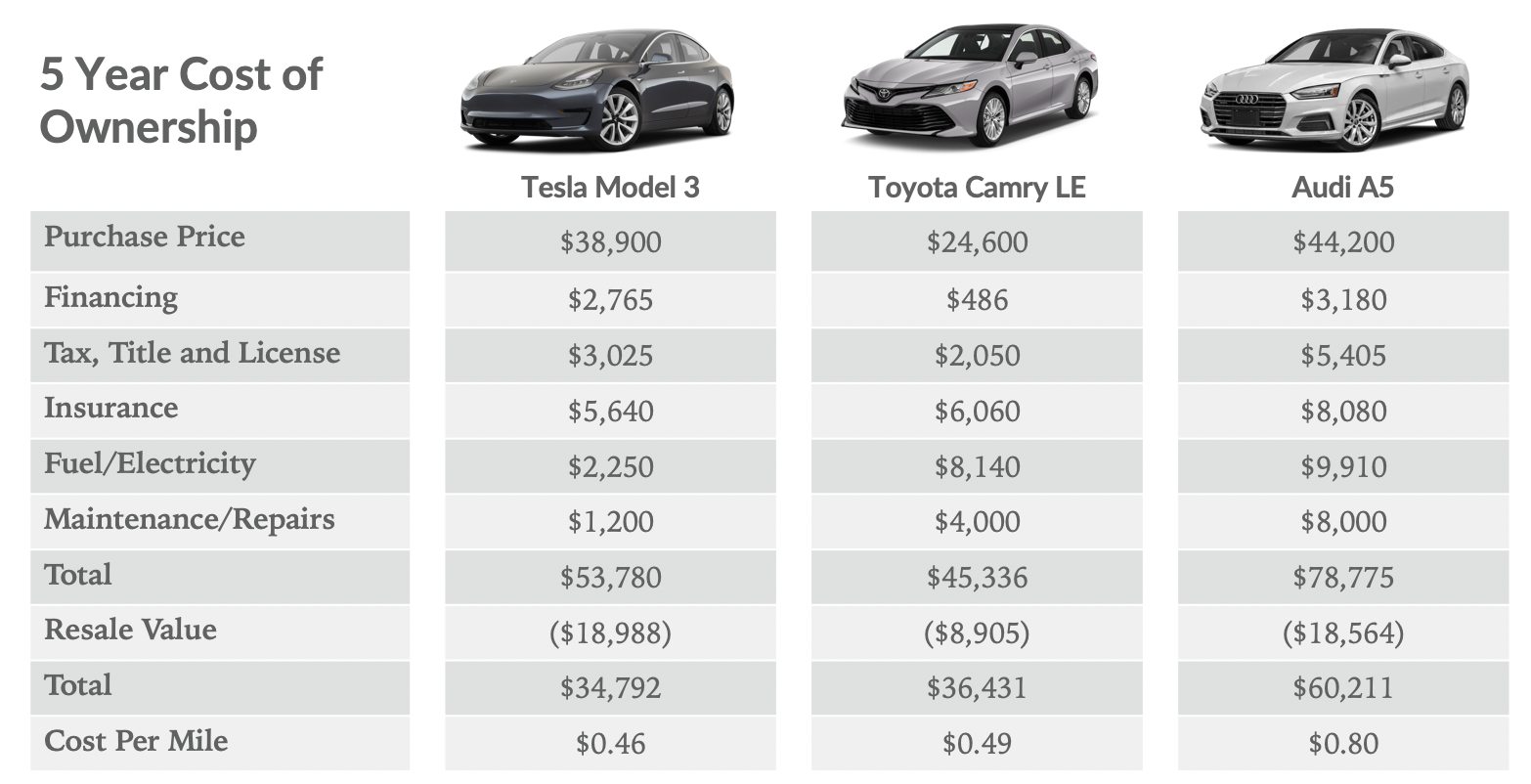

We’ve updated our 5-year cost of ownership study comparing a Tesla Model 3 to a Toyota Camry. The comparison gives us a look at how the Model 3 cost compares to a mass-market sedan.

- In 2017, our model concluded that while the Model 3 value proposition was weighed down by a 40% sale price premium, it would end up costing 13% more to own and operate over 5 years than a Toyota Camry LE.

- In 2019, we found the purchase price gap has widened to 59% ($35k Model 3 has not come to fruition), but the cost of ownership gap has also widened to 18% from 13%.

- Importantly, factoring in the resale value of the two vehicles (benefit of an EV is their ability to retain value), the Model 3 becomes 5% cheaper on a cost per mile basis.

- The bottom line: Model 3 is a superior car (electric, safer, Autopilot) compared to a Camry, and is slightly cheaper to own and operate over 5 years.

- Average all-in cost per mile for a Model 3 is $0.46, compared to the Camry LE at $0.49, and Audi A5 at $0.80.

Here are the notable changes from the previous model:

- The Model 3 purchase price increased. Our previous model anticipated a $35K Model 3 would be in the market, which hasn’t came to fruition. The entry-level Model 3 today is $38,900.

- The Camry LE price was essentially unchanged.

- We’re now factoring in resale value in our model.

- Gas prices increased 16% since our 2017 study. We continue to expect a 5% annual increase.

- Model 3 insurance is lower by 9%.

- We are shifting to a finance option. Previously we used a lease option. This slightly and uniformly increased interest payments for each car.

Luxury Status

As the Model 3 is still considered to be a luxury sedan, we compared it to another luxury vehicle of similar cost. When compared to an Audi A5, the Model 3 was 12% cheaper upfront but over 5 years is 32% cheaper to operate (42% cheaper with resale value included). While we still believe the Model 3 has the perks of a luxury vehicle, it’s evident that it can maintain those features at a significantly lower cost.

Cost of Insurance

The cost difference between insuring a Tesla Model 3 and a Camry SE is less than you might think. The average cost per year of insuring a Tesla Model 3 is $1,128 today, while the average cost to insure a Camry SE is $1,212. Research suggests that Tesla Model 3s are categorized by insurance companies as luxury vehicles, while the Camry SE is not. Our estimates show that the first two years of insurance will run you about $100 a month, with the third and fourth year dropping to $90 a month. This price reduction is correlated with Tesla’s rumored internal insurance program which is projected to begin this summer in North America, as it has already launched in both Australia and China. The goal with Tesla’s insurance program is to match rates of the lowest competitor. We predict that the price to insure a Camry over the next 5 years will increase at a rate of 0.5%. Based on our model, we predict the average difference in insurance costs over a 5-year ownership span to be $420 less for a Tesla than a Camry.

The car insurance game itself is a data operation and there just isn’t enough current data on Tesla to justify the low insurance costs they should receive based on their safety ratings. We see this transformation happening in two ways; insurance companies who see the value in Tesla’s safety rating and lower their rate accordingly, and Tesla owners beginning to use Tesla’s branded insurance.

Looking to the Future

We believe that our model is conservative and that there is still room for the Model 3 to become even cheaper to own. We decided not to include the US EV tax credit due to the fact that it will be phased out completely by the end of this year. However, there is an opportunity for new incentives to be introduced. We believe Tesla will shed its status as a premium luxury vehicle that is contributing to higher insurance and financing rates. As EV ownership grows and there is more data on their cost, we expect the long-term value proposition to shine through.

Original Study from 2017

Over the next 10 years the Model 3’s value, in combination with its technology, has the potential to change the world and accelerate the adoption of electric and autonomous vehicles. This should propel shares of TSLA higher and, more importantly, advance us to a new paradigm in transportation, car ownership, ride-hailing, city development, and energy usage. We believe we will eventually look back at the launch of the Model 3 and compare it to the iPhone, which proved to be the catalyst for the shift to mobile computing.

Model 3 Cost of Ownership Estimate Lower than Expected

Loup Ventures did an analysis of Tesla’s Model 3 total cost of ownership and the results surprised us: Owning a Model 3 is only 13% more expensive than owning a Toyota Camry over a 5 year period. Note that our analysis assumes no state or federal EV tax credits, given that we expect those incentives to end before Dec. 2020. Consensus thinking is the Model 3 expanded Tesla’s addressable market from about 1 million cars a year to 4 million cars a year. However, based on our cost of ownership work, we believe the Model 3 expands Tesla’s addressable market to about 11m vehicles per year in North America alone.

Owning a Model 3 is only 13% more expensive than owning a Toyota Camry over a 5 year period.

Tesla’s Opportunity

If Tesla captures 25% of this 11 million-vehicle addressable market by 2025, Tesla would generate $105 billion in annual revenue from the Model 3. It will likely take a few years for Tesla to ramp production; we see 2019 as the first year the company will tap into this broader market. Using the Street’s $20 billion revenue estimate as a starting point in 2018, and growing that to $105 billion in 2025 (from the Model 3 only) implies a 27% average annual growth rate for revenue from 2018-2025.

Profitability is a Wild Card

Most investors we’ve talked to ascribe to the “love the product, don’t like the stock” narrative. The most common cause for concern about owning shares of TSLA is a belief that the company has a decade of profitless prosperity ahead of it. It’s an understandable concern, given that in 2017 the Street is looking for around -5% operating margins, inching up to around +1% over the next several years. We believe the longer term operating margins can be closer to 15% based on our view that Tesla’s car and battery profitability are more like consumer electronics than traditional cars.

Hardware Can Scale

Imagining that Tesla could produce 2.5m cars by 2025 may seem hard to believe, especially given that the company only delivered about 100k cars in the past year. Hardware does not scale as easy as software, but it can scale. Looking back at the iPhone in 2007 it was a stretch to envision the company producing 50m phones a year, but in 2015, the company sold 232m units.

The Slow Rollout

Later this month, initial shipments of the Model 3 will be on the road with waitlisted deliveries starting in October. We believe there are more than 500k Model 3 reservations, with Tesla reporting 373,000 reservations placed six weeks after the vehicle’s preview on March 31, 2016. The reservation number would be higher but Tesla has been under selling pre-orders given the long lead times, including no advertising, anti-selling, and nothing to test drive. If you’re a first time Tesla buyer and reserve a Model 3 today, you should expect to get it in January 2019.

Autonomy is 2-3 Years Out

At a TED talk in April, Elon Musk suggested that Tesla will send a fully autonomous car from Los Angeles to New York by the end of 2017. The company has been clear that Tesla drivers should expect full autonomy by the end of 2019. In Musk’s words, “Once you solve cameras for vision, autonomy is solved.” GPS, radar, sonar, and computer vision all work together to create autonomy on a Tesla. We do not believe there are any existing sensor technologies (even LiDAR) that would add any incremental benefits to Tesla’s suite of autonomous technologies. There is, however, a missing piece in the suite related to “cameras for vision,” and that’s AI. Tesla is solving the AI challenge with a bottoms-up approach. Teslas that are on the road today using Autopilot are gathering data that’s being fed into Tesla’s autonomy AI. In about 2 years the company expects to have enough AI learning to turn on full autonomy at no additional cost. In other words, for every mile a Tesla drives today, traditional auto manufacturers fall a mile further behind.

Autonomy & the Fleet

Factoring in delays, we expect it will be 2-3 years before Tesla vehicles will be fully autonomous. In 3-5 years, we believe Tesla will have a new fleet service, comprised of both company-owned and customer-owned cars. When you’re not using your Tesla, turn it over to the fleet to earn money.

Can Tesla Meet its Ambitious Goals?

Tesla shares are down this week as the company announced 47,100 vehicles delivered in the first half of 2017, at the low end of its delivery goal of 47,000-50,000 vehicles. Coming in at the low end of the range makes it difficult for investors to believe Tesla will be successful in ramping Model 3 production to the levels they have outlined. Tesla believes it will manufacture 100 Model 3’s in the month of August and ramp production up to 20,000 in the month of December. Overall, Tesla’s goal is to deliver 500,000 cars annually by the end of 2018. Near-term, investors will grow weary of the risk to the quarterly production numbers. Long-term, investors should remain confident that production will ramp in time and the company will capitalize on growing demand for the Model 3.

Cost of Ownership Analysis:

Model 3 vs. Camry

We focused our total cost of ownership exercise on the Toyota Camry because it’s a good example of an affordable quality car sold in the U.S. At first glance, Camry is in a different segment than the Model 3, given that a Camry costs an average of 42% less than an average Model 3 and Camry is an ICE (internal combustion engine). However, looking at total cost of ownership, the price gap closes based on savings from fuel, insurance maintenance, and repairs, ultimately yielding a 13% price difference over 5 years.

Little Cost Difference, Infinitely Better Car

Tesla wins over a Camry when it comes to customer experience, due to its acceleration, Autopilot, elimination of gas station stops, and the high-quality entertainment system. There is evidence of this in a Consumer Reports survey, where 91% of Tesla owners state they would “definitely” buy their cars again, the highest rating of any automaker. The next two closest automakers were Porsche at 84% and Audi at 77%. As more Teslas find their way onto the road, the general public will become increasingly aware of the benefits of Tesla ownership and likely view the 13% total cost of ownership difference as insignificant. We expect this “see it and want it” phenomenon to cause an acceleration in Model 3 demand in 3-5 years. Detroit, Japan, and German car manufacturer feature shortfalls will compound around the end of 2020 when Tesla adds autonomy to approximately 2 million Teslas on the road virtually overnight (including all Teslas sold from Jun-17 through Dec-20). Note that every Tesla sold today has the hardware for full autonomy. When Tesla turns on full autonomy, we believe the market will tip away from traditional autos to Tesla.

Methodology

To calculate total cost of ownership over a 5-year ownership period, we used information released about the Model 3 and Model S. Additional costs to the advertised base price of $35,000 include: lease payments, initial down payment, interest rates, taxes and fees, insurance, Tesla fees, maintenance plans, repairs, and electricity costs, as shown in the figure below. In total, the additional costs are estimated to be $7,220 annually (over a period of 5 years), with a total cost of $36,104. The Model 3’s total cost of ownership is compared to the 2017 Toyota Camry LE and 2018 Audi S5 Coupe Prestige in the first figure below. We’ve also compared the Model 3 to the 2017 Model S in the second figure below.

Behind the Numbers

The base price of the Model 3 is 42% higher than the base price of the Toyota Camry; however, total cost of ownership of the Model 3 is just 13% higher than the total cost of ownership of the Toyota Camry. The Model 3 costs $7,220 per year, $847 more annually than the Camry at $6,373. For all car models we compared, we based our analysis on a 6% sales tax, 3.5% annual insurance increase, and 1.1% annual license tab fee. Regarding fuel and electricity differences, the U.S. Energy Information Administration reported prices of $2.37 per gallon and $0.12 per kWh. The average American drives 13,476 miles per year, and we calculated Tesla owners spending $541 on electricity annually, which saves $947 in fuel costs annually, or $15.43 per charge. Maintenance costs are low for Tesla models due to the vehicles only having 18 moving parts, compared to about 20,000 in an average ICE. They are less likely to malfunction, and if they do, the majority of the expensive parts are covered under warranty. After talking to our insurance companies, researching online, and talking to a salesman at the Tesla Dealership in Minneapolis, we estimate that the cost to insure a Tesla is the same price as a car half of its price, as noted in the tables. The main driver for the lower insurance rate is the high safety ratings of Tesla vehicles.

Our Analysis Excludes Tax & Fleet Benefit

Our analysis assumes no state or federal EV tax credits, given that we expect those incentives to end before Dec. 2020. Separately, our analysis excludes any benefit from the Tesla ride-hailing fleet, which we expect sometime between 2020-2025. Once Teslas are fully autonomous, we believe that Tesla owners will have an option to temporarily turn their car over to a fleet, allowing owners to earn income while saving on parking. Factoring in these two benefits would likely put the Model 3 total cost of ownership on par with the Camry.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.