Conclusion. Get ready for another $10 a month drag on your credit card. It’s a rebranded, all in one Apple video and music offering in 2-3 years.

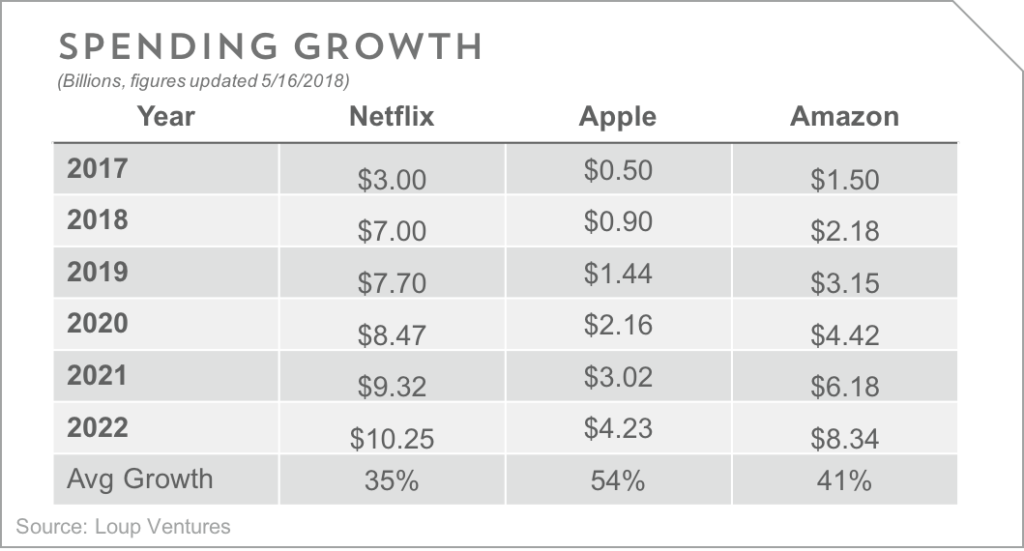

An Emerging Area of Investment. It’s no secret that original content will be an emerging area of investment for Apple, given it will boost the increasingly important Services revenue line. The good news is the trend of more cord cutting is undeniable and consumers paying for multiple monthly streaming services. Multiple streaming services means there will be a handful of content provider winners. The bad news is Apple’s efforts in content have been limited to “learnings” (Carpool Karaoke and Planet of the Apps). We think that will change over the next 5 years as Apple ramps its original content investment from about $500m in 2017 to our estimate of $4.2B in 2022. It’s worth noting this will still lag our 2022 estimates for original content spend (excludes catalog spend) by Amazon at $8.3B which will likely surpass Netflix at $6.8B.

Fighting To Reach 75m Subs. We define a winning content platform as having 75m+ monthly subs. That’s a tall order given it’s a crowded field with more than 200 subscription video services in Sep-17 (Parks Associates). These video services are working to catch up to the creative achievements of existing players. In 2017, HBO won 29 Emmys, (most for the 17th straight year), Netflix won 20, NBC 15, and Hulu 10. Looking at monthly subs, today’s leaders are Netflix (estimated to end 2017 with 115m subs) and Amazon (~80m global Prime subs). Hulu is the 3rd largest with 12-15m U.S. subs, but that doesn’t clear our 75m hurdle. Apple should be able to quickly expand their sub base given they have a running start with just over 30m Apple Music subs that will have access to the video offering for the same $10 per month. Even though Apple employs the “iTunes Store” nomenclature to sell most of its video content, we expect an all in one offering (music and video) to take the form of a rebranded Apple Music sometime in the next 2-3 years.

This note puts Apple’s content ambitions in context with the other players.

Apple. With over 30m Apple Music subs, Apple aims to bundle the music offering with an expanded selection of original content video (essentially two shows today) and will steer clear of license catalog content. Apple cares about original content because it will grow Apple’s Services business. Services will account for about 14% of revenue in CY17, growing at a high-teens rate for the next several years, which is more than double the growth rate of Apple’s hardware business. Separately, Services carry a gross margin which is around 2x Apple’s overall GM of 38%. We note content margins are slightly higher than Apple’s current business based on other streaming services’ margins that are around 45%. As Apple continues to invest in original content over the next few years (we estimate it will be around $800m-$1B in 2017), Services gross margin could decline by 3-5%, which would pressure overall Apple gross margin (currently at 38%) by about 0.5%. We expect will generally have a positive view of this growth vs. margin trade off given this is an investment in a measurable revenue generating in addition to Apple’s core business.

Adding Talent & Shows. Apple announced in early November they are developing a new TV show for its streaming service starring Jennifer Aniston and Reese Witherspoon. They beat out bids from Netflix and Showtime for the rights and could possibly spend over $10 million an episode, according to WSJ. The show, which doesn’t have a script yet, will follow the lives of morning news talk show anchors (think Today Show or Good Morning America). This is the second major content announcement for Apple recently, after announcing it is teaming up with Steven Spielberg to reboot his Amazing Stories series. On top of these two upcoming shows, Apple has been filling the ranks of its programming team with experienced entertainment executives. In late October Apple hired Jay Hunt, a rock star in UK original content, and in June hired Jamie Erlicht and Zack Van Amburg from Sony. Separately, these hires tie back to the acquisition of Beats and Jimmy Iovine joining Apple. Iovine was instrumental in bringing Erlicht and Amburg to Apple and has been the point man for Apple’s push into the original programming. Iovine has deep knowledge and a wealth of experience in the music industry — we consider him a “tastemaker” — and will likely work to expand their video offering into original programming, alongside their existing audio offering.

Rebranding Apple Music & iTunes. Obviously, what is offered with ‘Apple Music’ and in the ‘iTunes Store’ is more than just music, and is another data point Apple lags behind on name changes. Looking back, they were ‘Apple Computer, Inc.’ until 2007 when Steve Jobs decided to ditch ‘Computer’ to better reflect the products the company sold (the first iPhone model was released in 2007). In 2016, they dropped ‘Store’ from their physical retail locations, indicating the stores are more of an experience than simply a place where you buy things (e.g. Apple Fifth Avenue, Apple Lincoln Park, or “I need to stop at Apple”). With the rebranding and expansion of its content library Apple’s positioned to be a player in original programming.

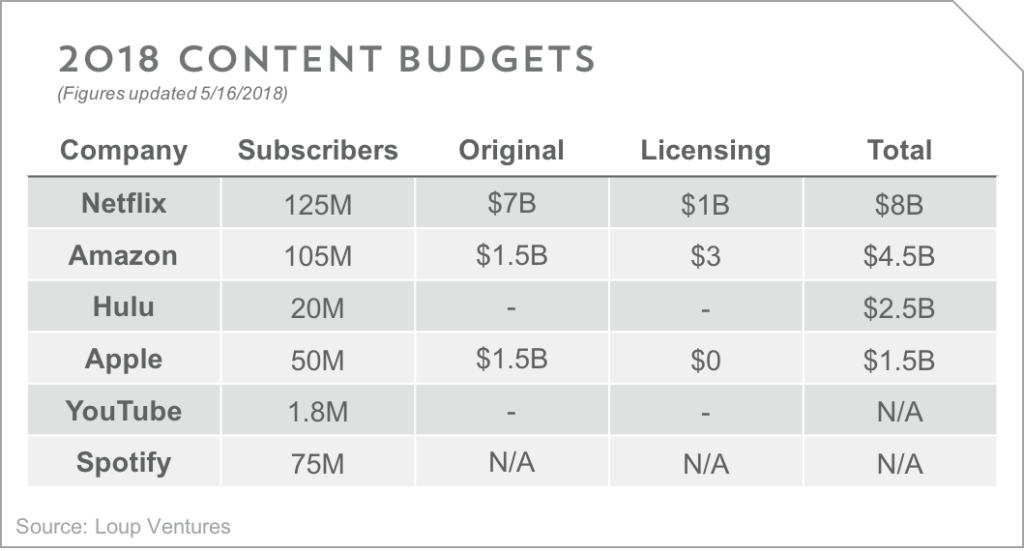

Netflix. With 115m subs globally (54m in the U.S) and expected to spend $7-8B in content in 2018, Netflix is the gold standard for over-the-top original programming. Over the years they have won 37 Emmy awards on 128 nominations, and hoping to increase that as they are expect to release 80 original films in 2018. Netflix’s strategy is to keep a steady stream of diverse content coming, as opposed to HBO for example with a few high-profile releases. They certainly have those prestige shows – Stranger Things, Narcos, The Crown, to name a few – but that is not the (sole) objective. Instead, Netflix focuses on offering a content library with a broad range of appeal to its diverse subscriber base, seeking overall commercial success ahead of critical successes here and there. They’re also rolling out this strategy internationally by continually entering new markets and even offering original shows in the local language for those international markets. Currently, native-language shows are available in Spain, Japan, Mexico, South Korea, Brazil, France, and Italy. Netflix has the largest library, budget, and geographic reach of the streaming services and will continue to be a formidable force for many years to come.

Hulu. Subs of 12-15m, U.S. only. Hulu will spend around $2.5 billion on content in 2017. While Amazon and Netflix will both spend more than twice that this year, it’s important to remember that Hulu is only available in the US, while Amazon and Netflix are both distributed internationally. Hulu also is not aiming to be a leader in original programming, instead using it to supplement their focus on licensing quality content from major TV networks. However, they have still had success with their original programs. The Handmaid’s Tale won an Emmy for Outstanding Drama Series, the first such award for a pure streaming service. They have begun bundling their service with others’, notably offering college students both Hulu and Spotify Premium for only $4.99/month. They have Cinemax and HBO add-ons to their service as well, though there are no discounts involved and are simply integrated into the Hulu app. Hulu’s approach is to offer as much quality content as possible, both originals and programming licensed from major networks (recently added 7,500 episodes in Q3).

Amazon. Subs of -90m Worldwide. We believe Amazon Studios’ content spend is budgeted at $4.5 billion for 2017, and they have recently communicated will increase in 2018. On the Sep-17 earnings call, Amazon said they were “bullish” on video given it helps drive more engagement and purchases on Amazon. Prime Video is only available to Amazon Prime members, and Prime members (as expected) spend about 3x more money than non-members. Amazon recently announced they’re expanding Amazon Studios, even after they’ve had management shakeups in the unit in the past month. Amazon Studios’ head resigned amid sexual harassment allegations, and they’ve added new heads of both scripted and unscripted content. Coupled with these management changes is a strategy change. CEO Jeff Bezos had indicated he’s looking to find a high-profile series with global appeal, and recently acquired the rights for a TV show based on J.R.R. Tolkien’s writings (i.e. The Lord of the Rings). Amazon paid $200-$250 million for the rights to the Tolkien IP (Bezos paid $250 million for The Washington Post in 2013), and will shoot two seasons for a reported $100 million each, bringing the financial commitment to nearly $500 million. This has the potential to legitimize their video entertainment ambitions in the eyes of non-Prime customers.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.